BUSINESS

How Independent Agents Help in Times of Claims: A Support System You Can Rely On

When managing insurance claims, having a reliable Independent Agents support system is invaluable. Independent agents stand out as essential allies during these times. They offer personalized assistance, act as intermediaries between policyholders and insurance companies, provide expert advice, and ensure that claims are processed efficiently and fairly. The role of independent agents goes beyond mere facilitation; they act as advocates for policyholders, providing clarity and support during stressful situations. This article will explore how independent agents are dependable support systems during the claims process, ensuring policyholders a seamless and stress-free experience.

Personalized Support

One of the key advantages of working with an independent agent is the personalized support they provide. Unlike tied agents, who represent a single insurer, independent agents have the flexibility to work with multiple insurance companies. This enables them to offer tailored advice that best suits your needs. According to experts like Mountain Insurance, independent agents strive to understand your unique circumstances and craft solutions that meet your requirements. This individualized approach is particularly beneficial when filing a claim, as the agent can offer customized guidance and support. By evaluating your particular needs and policy nuances, independent agents ensure you receive the most appropriate advice and support tailored to your unique situation.

Acting as Intermediaries

Navigating the claims process can be daunting, especially when dealing directly with insurance companies. Independent agents act as intermediaries, liaising between you and the insurer. Their in-depth industry knowledge and familiarity with claim procedures allow them to communicate effectively on your behalf. They handle paperwork, follow up on the progress of your claim, and keep you informed every step of the way. This intermediary role alleviates the stress of dealing with insurance companies, ensuring a smoother and more manageable claims experience. The ability to have a professional advocate on your side can significantly reduce the complexity and anxiety often associated with insurance claims.

Expert Advice and Guidance

Claims processes can often be complicated and filled with industry jargon that is challenging to decipher. Independent agents bring a wealth of expertise, offering invaluable advice and guidance. They help you understand your policy details, coverage limits, and the steps involved in filing a claim. Their expert insights enable you to make informed decisions, ensuring you receive the compensation you’re entitled to. Whether advising on documentation requirements, suggesting the best course of action, or helping you navigate potential pitfalls, independent agents provide the clarity and direction needed to navigate claims effectively.

Processing Claims Efficiently and Fairly

Efficiency and fairness are critical aspects of the claims process. Independent agents play a significant role in expediting claims and ensuring they are handled fairly. They use their industry connections and knowledge to push for timely assessments and resolutions. If a claim faces unwarranted delays or disputes, the agent can advocate on your behalf, pushing for fair treatment. Their involvement often leads to quicker settlements and more favorable outcomes. By leveraging their expertise and relationships within the industry, independent agents make the claims process more efficient and equitable for policyholders.

Conclusion

In times of claims, the role of independent agents cannot be overstated. They provide personalized support, act as effective intermediaries, offer expert advice, and ensure claims are processed efficiently and fairly. Their commitment to serving their clients’ best interests makes them invaluable to the insurance ecosystem. By working with an independent agent, you gain a trusted partner who stands by you, offering the support you need during one of the most critical times in your insurance journey. Combining personalized attention, expert guidance, and effective advocacy makes independent agents a crucial asset in navigating the complexities of insurance claims.

The presence of an independent agent provides practical assistance and emotional reassurance, knowing that you have a knowledgeable and dedicated professional by your side. This support system can significantly alleviate the stress and uncertainty often associated with insurance claims, allowing you to focus on recovery and rebuilding. As you consider your insurance options, partnering with an independent agent can provide the confidence and peace of mind that you are well-prepared and well-supported, no matter what challenges arise.

BUSINESS

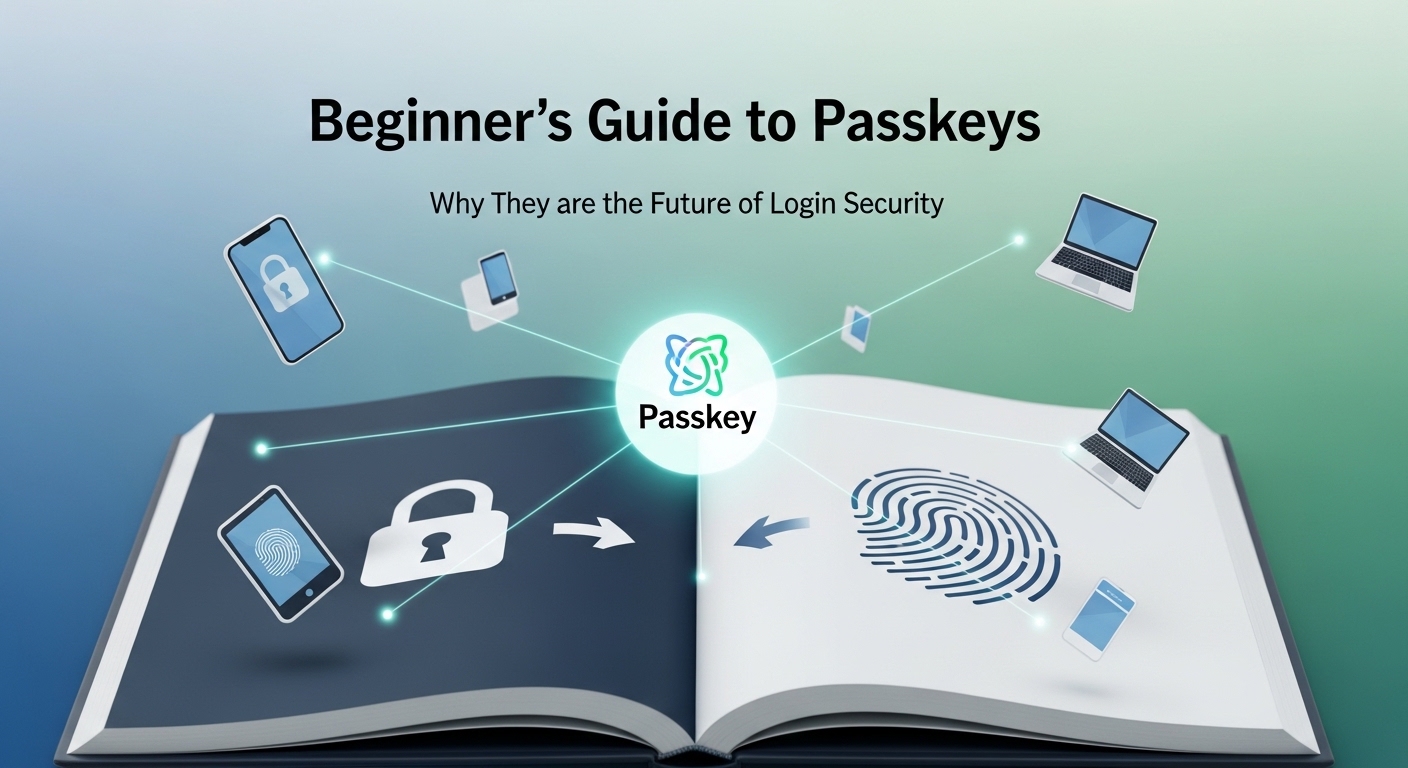

Beginner’s Guide to Passkeys: Why They are the Future of Login Security

Passkeys have become the reason that the days of memorising long passwords are behind us. Authentication is now safer, more seamless, and a little more sophisticated. Understanding what is passkey, and how it works on a fundamental level is important for anyone who is doubtful about its usability. While the term and the process itself might seem very technical, it’s quite simple—and that is what we’ll explain in this blog.

How Passkeys Work (Without the Tech Jargon)

To explain it simply, a passkey is like a digital handshake between your device and the service that you’re logging into. Step by step, here’s how it looks:

- You register, and your device generates both a public and a private key.

- The private key is on your device and stays there. It is not accessible to anyone else.

- The public key, on the other hand, is shared with the service, so it’s in the server.

When you log in, the service sends a cryptographic challenge that only a private key can sign. This signed challenge is then sent back to the server, which verifies it using the corresponding public key. At no point in this process is a traditional password generated, shared, or stored externally. This explains What is passkey in practice—a secure authentication method where credentials remain protected on the user’s device, making them immune to interception, phishing, or credential theft.

To make the correlation easier to understand, think of it like proving ownership of a safe without opening it. The server knows that it belongs to you, and no one else can open it. So you intermediate a process that is secret to the two of you.

Why Hackers Can’t Steal What You Don’t Know

Passkeys have an innate advantage—they are inherently phishing-resistant. Traditional credentials, such as passwords, can be stolen through fake or look-alike websites, but passkeys are cryptographically bound to the correct origin. This is a key part of what is passkey security. Even if a user is tricked into visiting a malicious site, the private key stored on the device will refuse to authenticate because the domain does not match the registered public key, effectively blocking phishing attacks at the source.

The thing with passwords is that if you guess the correct one, you have access to what you’d call basically the whole online presence of a person. Passkeys, on the other hand, cannot be used like that.

One, each login uses a unique cryptographic challenge, so even if a response were intercepted, it couldn’t be reused. Secondly, the private key never works in isolation—authentication is only possible when the server verifies it against the matching public key. The design works on a very fundamental security model. So instead of relying on human vigilance and hackers benefiting from the fatigue of it, this cryptographic system helps you stay secure with minimal effort.

One Key, All Devices

One concern with device-bound credentials is mobility. Modern passkey systems solve this with secure syncing.

- Passkeys can move across devices within a trusted ecosystem.

- The private key can be securely synced across trusted devices using end-to-end encrypted cloud services, without exposing it in readable form.

- When you log in from a new device, the system verifies your identity and provisions access without exposing the private key.

This means your passkey is portable but never exposed, allowing smooth access from phones, tablets, laptops, or desktops.

What If You Lose Your Phone? What’s the Recovery Process

This is a common concern, but Passkey anticipates it. Recovery can be done via trusted backup devices and cloud-synced credentials.

- If one device is lost, your other devices or secure cloud backups can generate a new key pair.

- The old key is revoked, preventing unauthorised access.

- Recovery is user-driven but cryptographically enforced, ensuring security isn’t compromised even during emergencies.

This approach removes the fear of being locked out and losing your data. This thing is common with both passwords and passkeys; they’re recoverable.

Goodbye MFA, Speeding Up Your Login Without Losing Safety

Passkeys combine authentication and verification in one step, removing the need for separate multi-factor prompts, such as SMS codes or authenticator apps, in many cases.

- Device authentication (biometric or PIN) acts as both “something you have” and “something you are”.

- This simplification reduces friction without reducing security.

- Users can authenticate in seconds while organisations maintain cryptographically strong login guarantees.

Essentially, passkeys achieve passwordless, MFA-equivalent security automatically.

Setting the Foundation: What You Gain From Using Passkeys

By understanding and adopting passkeys, users and organisations benefit from:

- Elimination of shared secrets, making stolen passwords obsolete.

- Strong cryptographic authentication that is origin-bound and phishing-resistant.

- Seamless multi-device access without compromising security.

- Streamlined user experience, removing friction from login flows.

- Passkeys help organisations meet modern authentication and security control requirements found in many compliance frameworks.

These features make passkeys not just a replacement for passwords but a redefinition of digital identity itself.

Conclusion

By now, you know the answers to – What is passkey and how can it benefit you? Passkeys can provide a stronger, faster, and more intuitive alternative to traditional passwords in terms of authentication. They are smart, reliable, and require minimal effort from your end. Remembering passwords can be a hassle, and that is something you do not have to worry about anymore. Passkeys do the heavy lifting for you, here

BUSINESS

Lead Generation Packages for B2B Success

Companies deal with unpredictable pipelines more often than they’d like. One month looks great, the next one is quiet. That kind of inconsistency slows growth and makes forecasting tough. Lead generation packages solve this by providing businesses with a repeatable, structured system rather than scattered efforts. You get clarity on what’s being done, who’s being targeted, and when results should show up.

What’s Typically Included in B2B Lead Generation Packages

A solid package covers every step required to find and engage the right buyers. It keeps outreach unified, consistent, and tied to your Ideal Customer Profile.

- Prospect research & ICP refinement: This begins with defining the right prospects. A team reviews your ICP, analyzes markets, and builds targeted lists of decision-makers. The goal is to make sure outreach focuses on companies that actually match your offer.

- Multi-channel outreach (email, LinkedIn, calls): Reaching prospects through several channels increases response rates. Packages usually include coordinated outreach via email, LinkedIn, and phone, ensuring your message reaches prospects where they prefer to communicate.

- Messaging creation & personalization: Strong outreach depends on relevant, human-sounding messaging. Teams write email sequences, LinkedIn scripts, and calling guides tailored to your industry. Personalization is added to help you stand out from generic campaigns.

- Data validation, enrichment, and QA: Good data is at the core of predictable results. Every contact is checked, verified, and enriched to reduce bounce rates and avoid wasted outreach. Ongoing QA keeps campaigns clean and compliant.

Learn more about the key cost drivers behind lead generation services, how different package tiers influence overall spend, and what factors businesses should evaluate before choosing an option.

Types of Lead Gen Packages

Lead generation isn’t one-size-fits-all. Different companies have different levels of readiness, sales cycles, and goals, so packages are built to match those stages. Below are the three most common options, along with the types of businesses they’re designed for.

Pilot Package

A pilot package is the safest starting point for teams that want to test outbound without committing to a long-term plan. It’s ideal for companies that are exploring a new ICP, entering a fresh market, or simply unsure how well outbound will work for their offer.

This option usually runs for one to two months and focuses on a smaller volume of outreach. The goal is fast learning. You see which messaging resonates, which titles get the most replies, how long the sales cycle feels, and whether your product speaks to the prospects you’re targeting.

The pilot package works especially well for startups, companies launching new products, or B2B teams that have relied primarily on referrals and inbound and want to add outbound without risk.

Growth/Business Package

The business growth package is for companies that already know their ICP and want predictable monthly meetings. It’s built for teams that need stability: steady outreach, steady performance, and a precise monthly flow of qualified conversations.

This package usually includes larger volumes of research, multi-channel outreach, richer personalization, and ongoing optimization. It’s the sweet spot for most B2B companies.

Sales teams benefit the most here: SDRs get a reliable stream of leads instead of scrambling for prospects, and founders no longer rely on sporadic outreach. If your next step is scaling revenue, increasing deal flow, or shortening the gap between closed deals, this package is a strong fit.

Enterprise Package

Enterprise packages are built for companies with broad territories, complex buyer journeys, or aggressive growth goals. They’re designed for teams that need outbound running across multiple markets, industries, or product lines simultaneously.

These packages handle high outreach volumes, deeper levels of research, and custom workflows integrated with internal systems. They often include multiple SDRs, multilingual outreach, advanced reporting, and detailed performance tracking.

Enterprise fits companies with mature sales operations, larger teams, or VP-level growth targets where consistency, scale, and cross-market coverage are non-negotiable. It’s the best choice for organizations that treat outbound as a long-term engine rather than a temporary boost.

Key Factors to Consider When Choosing a Package

Choosing the right lead generation package comes down to understanding what your team needs today and what will matter in a few months. A package should match your goals, support your sales process, and give you the level of control you want over results. Here are the core factors to look at before committing to anything:

- Monthly lead/meeting volume: Ensure it aligns with your sales capacity. Too few meetings slow growth, but too many can overwhelm a small team. The right package fits your bandwidth and revenue targets.

- Channel mix: Effective outbound uses multiple channels. Packages that combine email, LinkedIn, and phone outreach usually bring stronger response rates. Check if the provider adapts the mix to your audience.

- Quality of data and research standards: Strong results depend on accurate contact data. Look for manual research, verification steps, and clear QA practices. Poor data leads to bounces, low reply rates, and wasted time.

- Industry-specific expertise: If your market is niche or technical, the team running your outreach should understand it. Familiarity with your industry improves messaging, targeting, and overall performance.

When these factors align, a lead generation package becomes a reliable growth engine rather than an experiment.

Conclusion

Structured packages give companies a clear path to steady growth. Instead of chasing inconsistent outreach or guessing what to try next, you get a system that delivers qualified conversations every month. The research, messaging, outreach, and reporting all work together, making results easier to track and improve.

BUSINESS

Why Every Business Needs Professional Graphic Design Services

In today’s competitive marketplace, businesses rely heavily on visual communication to attract customers, build trust, and stand out from competitors. Whether you are a start-up or an established company, investing in professional graphic design services is essential for shaping how your audience perceives your brand. Great design is more than decoration; it is a strategic tool that influences customer decisions, communicates brand values, and creates memorable experiences.

This article explains why professional design is critical for every business and how it helps build strong branding, clear communication, and long-term customer loyalty.

The Power of Visual Branding in Modern Business

Branding is no longer limited to logos and color schemes. It includes the complete visual identity that customers associate with your business. This identity must be consistent across your website, social media, print materials, and physical signage. Professional graphic design services ensure that your branding is cohesive, modern, and aligned with your business goals.

Strong visual branding:

- Builds trust and credibility

- Enhances customer recognition

- Differentiates your business from competitors

- Creates emotional connections

- Supports long-term brand loyalty

When customers see professionally designed materials, they associate your business with quality and reliability.

Why Professional Graphic Design Services Matter

Many business owners try to use free online tools or templates for their design work. While these tools are helpful, they cannot replace the expertise of a trained designer. Professional designers understand color psychology, typography, layout balance, composition, and branding strategy. This knowledge allows them to create visuals that are not only attractive but also effective in communication.

1. Enhancing First Impressions

The first impression of your business often comes from your visuals. Whether it is a business card, website banner, brochure, or social media ad, your design plays a major role in shaping expectations. People decide within seconds whether they trust a brand, and design is at the center of this decision.

Professional graphic design services ensure that every touchpoint creates a positive first impression that encourages people to explore your business further.

2. Strengthening Brand Recognition

Customers remember brands through consistent visual cues. This includes your logo, fonts, colors, and layout style. A professional designer ensures that these elements work together seamlessly. Over time, this consistency improves brand recall and makes your business easily identifiable in a crowded marketplace.

This is especially important for businesses in industries with high competition. Well-designed branding becomes a strong differentiator.

3. Improving Communication with Your Audience

Effective visuals simplify complex messages. For example, infographics, diagrams, icons, and illustrated guides can help customers understand your products or services faster. Professional designers know how to structure information visually so it is engaging, simple, and persuasive.

Clear communication is essential in marketing. When your message is visually appealing, customers are more likely to take action, whether visiting your website, making a purchase, or contacting you for a service.

4. Supporting Marketing and Advertising Efforts

Marketing campaigns rely on strong visuals. From social media ads to promotional flyers, professional graphic design services help create materials that capture attention and drive engagement. A good design increases the chances of people clicking on your ad, reading your content, or responding to your call-to-action.

Bad design, on the other hand, can cause customers to scroll past your posts or ignore your promotions entirely. Design quality directly affects marketing results.

Investing in Professional Design Builds Customer Trust

Trust is a major factor in every customer’s purchasing decision. If your brand visuals look outdated, inconsistent, or unprofessional, customers may assume your products or services lack quality as well. Investing in professional design makes your business appear credible and reliable.

Good design demonstrates that your business cares about quality and pays attention to detail. This creates confidence and encourages customers to choose your brand over others.

How Custom Designs Elevate Your Brand Identity

Templates may be cheap and convenient, but they look generic. Custom designs reflect your unique story, mission, and personality. Professional designers take time to understand your brand, audience, and goals before creating visuals that represent you accurately.

This is where Custom graphic design solutions from Kwik Kopy become especially valuable. These services provide unique, tailored designs that help your brand stand out across digital and print channels.

Advantages of Custom Design

- Unique visuals that match your brand voice

- Better alignment with your target audience

- Adaptability across marketing materials

- Enhanced professionalism and brand appeal

- Stronger long-term brand consistency

Custom graphic design solutions from Kwik Kopy ensure that your brand communicates its message clearly and stands out against competitors who rely on generic templates.

How Graphic Design Influences Customer Decisions

Design plays a psychological role in how people interact with brands. The colors you use can trigger emotions. The layout of your website can influence whether visitors stay or leave. The professionalism of your printed materials can determine whether clients trust you.

Here are a few ways design affects customer behavior:

- Color choices influence mood and brand perception

- Typography impacts readability and tone

- Layout affects engagement and decision-making

- Visual hierarchy guides attention and improves message clarity

Every design choice affects how customers interpret your brand.

Examples of How Custom Printing Helps Brands Stand Out

Although this article focuses on design, printing plays a major role in brand presentation. Custom printing transforms digital designs into tangible brand assets.

Here are examples of how businesses use printing to make an impact:

- High-quality brochures with premium finishes build trust in professional services

- Branded packaging enhances customer experience and increases perceived product value

- Custom business cards leave a strong impression in networking events

- Printed banners and signage make brands more visible at trade shows

- Branded stationery reinforces identity in corporate communication

When combined with Custom graphic design solutions from Kwik Kopy, printed materials become powerful tools for marketing and customer engagement.

Why Every Business Size Benefits from Professional Design

Whether you run a small local shop or a large corporation, design influences how customers perceive you. Small businesses often gain the most from investing in quality design because it helps them appear more credible and compete with larger brands. Major companies, on the other hand, rely on graphic design services to maintain consistency across multiple platforms and campaigns.

Professional design scales with your business and adapts to your ongoing needs, ensuring your branding stays modern and competitive.

Conclusion

Professional graphic design services are essential for every business that wants to grow, build trust, and communicate effectively. High-quality visuals strengthen brand identity, improve customer engagement, and support marketing efforts. With expert designers, your brand gains a polished, consistent, and memorable appearance that attracts customers and sets you apart.

-

HEALTH2 years ago

HEALTH2 years agoTransformative Health Solutions: Unveiling the Breakthroughs of 10x Health

-

GENERAL2 years ago

GENERAL2 years agoDiscovering the Artistic Brilliance of Derpixon: A Deep Dive into their Animation and Illustration

-

Posts2 years ago

Posts2 years agoSiegel, Cooper & Co.

-

Lifestyle2 years ago

Lifestyle2 years agoPurenudism.com: Unveiling the Beauty of Naturist Lifestyle

-

FASHION2 years ago

FASHION2 years agoThe Many Faces of “λιβαισ”: A Comprehensive Guide to its Symbolism in Different Cultures

-

Lifestyle2 years ago

Lifestyle2 years agoBaddieHub: Unleashing Confidence and Style in the Ultimate Gathering Spot for the Baddie Lifestyle

-

Entertainment2 years ago

Entertainment2 years agoGeekzilla Podcast: Navigating the World of Pop Culture, Gaming, and Tech

-

Lifestyle2 years ago

Lifestyle2 years agoSandra orlow: Unraveling the Story of an Iconic Figure