GENERAL

A Guide to Buying a Service-Based Business in a New City

Relocating to a new city is an exciting adventure, but it also presents challenges—especially for entrepreneurs looking to invest in an established business. One of the best ways to integrate into a new community while securing financial stability is by purchasing a service-based business. From plumbing and HVAC companies to cleaning services, these businesses offer steady demand and reliable income. But how do you evaluate and purchase one in an unfamiliar location?

Why Choose a Service-Based Business?

Service-based businesses, particularly those in essential industries like plumbing, electrical work, and home maintenance, provide a stable customer base and recession-resistant opportunities. Here’s why they make a smart investment:

- High Demand: People always need home repairs, cleaning, and maintenance services.

- Recurring Revenue: Many service businesses operate on contracts or repeat customers.

- Lower Risk: Compared to startups, existing businesses have proven revenue streams and established customer relationships.

Steps to Buying a Service-Based Business1. Research the Local Market

Before making a purchase, it’s crucial to understand the local economy and demand for service businesses. Consider:

- Population growth and demographics

- Competitor presence and market saturation

- Cost of doing business (permits, taxes, regulations)

- Identify the Right Business

Not all service businesses are equal. When selecting one, focus on:

- Reputation and customer reviews

- Financial performance and profit margins

- Employee retention and skill levels

- Growth potential in the new city

- Evaluate Business Worth

Determining the value of a service business is essential before making an offer. If you’re considering purchasing a plumbing company, for example, you may wonder,how much is a plumbing business worth? Factors like annual revenue, customer contracts, and brand reputation all play a role in its valuation.

- Secure Financing and Close the Deal

Buying a business requires capital. Explore financing options such as:

- Bank Loans – Traditional funding with structured repayment terms.

- SBA Loans – Government-backed loans with favorable interest rates.

- Seller Financing – The current owner finances part of the purchase.

- Investor Partnerships – Collaborate with business partners or private investors.

Once financing is secured, work with an attorney to finalize contracts, licenses, and business transfers.

Conclusion

Purchasing a service-based business in a new city is a strategic move for entrepreneurs looking for a stable and profitable investment. By researching the market, selecting the right business, and securing financing, you can successfully transition into business ownership. Whether you’re looking at a plumbing company or another essential service, evaluating its worth and long-term potential is key to making a smart investment.

GENERAL

Stanford-Markets.com Review Exploring Global Trading Opportunities

The Stanford-Markets.com review reveals a platform that provides traders with seamless access to financial markets worldwide. Whether trading stocks, forex, cryptocurrencies, commodities, or indices, the Stanford-Markets.com review highlights its ability to connect users to multiple global exchanges with competitive pricing and low spreads. With a focus on accessibility and market diversity, the platform caters to both beginners and experienced traders looking to expand their portfolios.

At Stanford Markets, users benefit from a range of account types designed to suit different trading needs, from basic to VIP levels. The platform ensures traders can maximize opportunities by offering flexible leverage, tight spreads, and real-time market insights. Advanced trading tools, such as customizable charting software and automated analysis, empower users to make informed decisions. Furthermore, the Stanford Markets company prioritizes security and transparency, implementing strict regulatory compliance and encryption measures to protect traders’ funds and personal data.

Trade Globally with Ease

Stanford Markets provides traders with seamless access to global financial markets, allowing them to trade stocks, forex, commodities, indices, and cryptocurrencies from a single platform. With advanced technology and a user-friendly interface, traders can execute transactions efficiently, no matter where they are in the world. The platform offers multi-device compatibility, enabling trading across desktops, tablets, and mobile phones, ensuring users never miss a market opportunity.

One of the standout features of the Stanford Markets platform is its ability to connect traders with major stock exchanges and forex markets worldwide. By offering a wide range of tradable assets, the platform empowers investors to capitalize on international market trends and diversify their strategies. Additionally, real-time market updates, advanced charting tools, and one-click trade execution make global trading more accessible and efficient. Whether a trader is looking to invest in European stocks, Asian commodities, or North American indices, this platform provides the tools necessary to navigate these markets with ease.

Diversify Your Portfolio

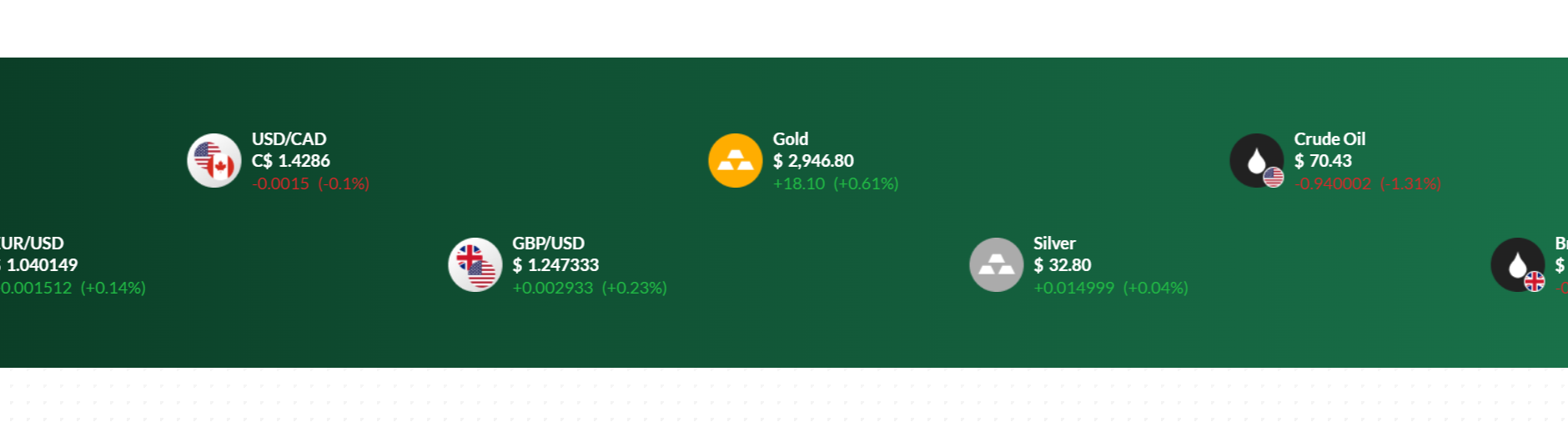

Diversification is a key strategy for mitigating risk and maximizing returns, and this platform makes it simple to build a well-balanced portfolio. With access to multiple asset classes, including forex, stocks, indices, commodities, and cryptocurrencies, traders can spread their investments across different markets to reduce exposure to volatility.

By offering a variety of trading instruments, Stanford Markets allows users to take advantage of market movements across various sectors. For instance, while stock prices may be affected by corporate earnings reports, commodities such as gold or oil can provide stability during uncertain economic times. Additionally, forex trading offers opportunities to profit from currency fluctuations, and cryptocurrencies present high-growth potential for those willing to embrace digital assets.

Stanford Markets provides educational resources and expert market insights to help traders develop smart diversification strategies. With customizable risk management tools, including stop-loss and take-profit features, traders can efficiently balance their portfolios while maintaining control over their investments.

Low Spreads, High Gains

One of the most critical factors in trading profitability is the cost of transactions. This platform ensures that traders maximize their earnings by offering low spreads and competitive pricing. Spreads—the difference between the bid and ask price—directly impact a trader’s ability to make profits, and tight spreads help minimize these costs.

Lower spreads mean that Stanford Markets traders can enter and exit positions with minimal expense, making it easier to capture short-term price movements. Whether trading forex, stocks, or commodities, this platform provides cost-effective trading conditions to help users optimize their profits. Additionally, there are no hidden fees or unexpected charges, ensuring full transparency in pricing.

For active Stanford Markets traders, this pricing model offers significant benefits. The platform also provides different account types with varying spread structures, allowing users to choose the best fit for their trading style. From beginner traders looking to start with low-cost trades to high-volume professionals needing ultra-tight spreads, this platform caters to all levels of experience.

Secure & Transparent Trading

Security and transparency are fundamental to a successful trading experience, and this platform prioritizes both to protect its users. The Stanford Markets platform employs state-of-the-art encryption technology to safeguard client data and transactions. Additionally, strict compliance with financial regulations ensures that all trading activities are conducted with the highest levels of integrity.

Traders can be confident that their funds are protected through segregated accounts, preventing misuse of client capital. The Stanford Markets platform also implements two-factor authentication (2FA) and other security protocols to enhance account protection. These measures minimize risks associated with cyber threats and unauthorized access.

Transparency is another cornerstone of the platform. All fees, spreads, and commissions are clearly outlined, ensuring traders understand the costs associated with their trades. The company operates with full regulatory compliance, reinforcing trust and reliability among its users. With a commitment to ethical trading practices, the platform creates an environment where traders can focus on their strategies without worrying about security breaches or hidden charges.

Real-Time Market Insights

In the fast-paced world of trading, having access to real-time market data can be the difference between success and missed opportunities. This platform equips traders with live price feeds, instant news updates, and expert analysis to help them make informed decisions.

The Stanford Markets platform’s advanced analytics tools provide users with real-time charts, technical indicators, and economic calendars to track key market events. Whether analyzing currency trends, stock performance, or commodity price fluctuations, traders can use these insights to refine their strategies. Additionally, the platform offers customizable alerts and notifications, ensuring traders never miss critical market movements.

Beyond just numbers, the platform provides deep-dive market analysis from industry professionals. These insights help traders stay ahead of global economic shifts and understand how major events impact different asset classes. By staying informed and leveraging real-time data, traders on this platform can confidently navigate the markets and seize profitable opportunities.

Conclusion of the Stanford-Markets.com Review

In conclusion, this platform offers an all-encompassing trading experience, giving users access to global markets, diverse asset classes, and an array of advanced tools to help maximize their potential. For anyone seeking to expand their portfolio and trade efficiently across multiple markets, this platform is an ideal choice. As highlighted in this Stanford-Markets.com review, the combination of low spreads and high-quality trading tools ensures traders can make the most of every market opportunity.

If you’re ready to take the next step in your trading journey, consider exploring all the offerings detailed in this Stanford-Markets.com review. With cutting-edge features, a wide range of tradable assets, and unwavering support, Stanford Markets a competitive edge for both beginners and experienced traders. By joining, traders can diversify their strategies and achieve financial goals while enjoying a secure and efficient trading experience.

This article is provided for informational purposes only and is not intended as a recommendation. The author disclaims any responsibility for the company’s actions in the course of your trading activities. It’s important to understand that the information presented in this article may not be entirely accurate or current. Your trading and financial decisions are your own responsibility, and it is vital not to rely solely on the content provided here. We make no warranties about the accuracy of the information on this platform and disclaim any liability for losses or damages arising from your trading or investment decisions.

GENERAL

Small Space Solutions: Designing a European Kitchen in a Compact Area

The charm of European kitchen design lies in its perfect blend of functionality, elegance, and minimalism. Known for their sleek aesthetics and efficient use of space, European kitchens are a popular choice for homeowners and designers alike. But what happens when you want to bring this sophisticated style into a compact area? Designing a functional and stylish European kitchen in a small space is not only possible but also an exciting challenge that can yield stunning results.

In this blog, we’ll explore practical solutions and design tips to help you create a European-inspired kitchen in even the smallest of spaces. Whether you’re designing for an urban apartment or a cozy studio, these strategies will help you maximize efficiency without compromising on style.

1.Embracing Minimalism: The Foundation of European Design

At the heart of European kitchen design is minimalism. Clean lines, uncluttered surfaces, and a focus on functionality define this style. In compact spaces, this approach becomes even more critical. Begin by decluttering and prioritizing essential items. Every element in your kitchen should serve a purpose while contributing to the overall aesthetic.

Opt for handleless cabinets or sleek hardware to maintain a streamlined look. Glossy finishes, such as lacquer or high-gloss acrylic, reflect light and create the illusion of a larger space. Neutral color palettes—think whites, grays, and soft pastels—further enhance the airy and open feel of a small kitchen.

2.Smart Storage Solutions

One of the biggest challenges in small kitchens is finding enough storage without overwhelming the space. European kitchens excel in offering innovative storage solutions that make the most of every inch.

Vertical Storage: Take advantage of vertical space by installing tall cabinets that reach up to the ceiling. Use the upper sections for less frequently used items and keep everyday essentials within easy reach.

Pull-Out Systems: Incorporate pull-out shelves, corner units, and pantry organizers to maximize accessibility and minimize wasted space. These systems are perfect for storing pots, pans, and pantry goods in an organized manner.

Integrated Appliances: Opt for built-in appliances like refrigerators, ovens, and dishwashers. These not only save space but also maintain the seamless, cohesive look characteristic of European kitchens.

Multi-Functional Furniture: Consider furniture pieces that serve dual purposes, such as an island with built-in storage or a foldable dining table that can be tucked away when not in use.

3.Efficient Layouts for Small Spaces

The layout of your kitchen plays a significant role in its functionality. In small spaces, every square foot counts, so it’s essential to choose a layout that maximizes efficiency.

Galley Kitchens: A galley layout is ideal for narrow spaces. By placing cabinets and appliances along two parallel walls, you create a streamlined workflow while utilizing both sides effectively.

L-Shaped Kitchens: For small corners or open-plan designs, an L-shaped layout works well. This configuration provides ample counter space while leaving room for movement.

One-Wall Kitchens: In extremely compact areas, a one-wall layout keeps everything within easy reach while maintaining an open feel. Pair it with a movable island or bar cart for added functionality.

No matter the layout you choose, remember to follow the kitchen work triangle principle: position the sink, stove, and refrigerator in close proximity to create an efficient workspace.

4.Lighting: The Key to Opening Up Small Spaces

Proper lighting can make even the smallest kitchen feel more spacious and inviting. In European kitchen design, lighting is both functional and decorative.

Natural Light: Maximize natural light by keeping windows unobstructed and using sheer curtains or blinds. If possible, position your sink or countertop near a window to take advantage of daylight.

Task Lighting: Install under-cabinet lighting to illuminate work surfaces without casting shadows. This not only enhances functionality but also adds a modern touch to your kitchen design.

Ambient Lighting: Use recessed lighting or pendant lights to create a warm and welcoming atmosphere. Choose fixtures with clean lines and minimalist designs to stay true to the European aesthetic.

5.Materials That Define European Kitchens

The choice of materials can elevate your small kitchen’s design while ensuring durability and ease of maintenance. European kitchens often feature high-quality materials that exude sophistication without being overly ornate.

Countertops: Quartz and solid-surface countertops are popular choices for their sleek appearance and low-maintenance properties. Choose lighter shades to brighten up the space.

Cabinetry: Opt for flat-panel cabinets with smooth finishes like matte or high-gloss lacquer. These materials are not only visually appealing but also easy to clean—an essential feature for small kitchens where every surface is used frequently.

Backsplashes: A simple subway tile backsplash or a seamless glass panel can add texture and interest without overwhelming the space. Consider using reflective materials to enhance light distribution.

6.Adding Personality with European Flair

While functionality is key in small kitchens, don’t forget to infuse your design with personality and charm. European kitchens often feature subtle yet impactful details that make them stand out.

Open Shelving: Incorporate open shelves to display stylish dishware or decorative items. This adds visual interest while keeping the space feeling open and airy.

Accent Colors: Use small pops of color through accessories like bar stools, dish towels, or countertop appliances. Keep these accents minimal to maintain the clean aesthetic.

Greenery: Bring life into your kitchen with potted herbs or small plants. Not only do they add freshness, but they also align with the natural elements often seen in European designs.

Conclusion

Designing a European kitchen in a compact area requires careful planning and attention to detail, but you don’t have to do it alone! At OPPOLIA Home, we specialize in creating custom cabinetry tailored to your unique needs and space constraints. With over 10 years of experience in crafting bespoke solutions, we offer a wide range of options that combine functionality with timeless design.

Whether you’re looking for sleek cabinets, innovative storage solutions, or integrated appliances, our team is here to bring your vision to life. Let us help you transform your small kitchen into a stunning European-inspired space that maximizes every inch without compromising on style.

Contact us today for a free quote and discover how OPPOLIA Home can be your trusted partner in achieving your dream kitchen!

GENERAL

Are you spending more than you earn

Money isn’t always the easiest thing to manage, and sometimes, it feels like the more you earn, the more you end up spending. We’ve all been there—whether it’s treating yourself to a night out, buying the latest gadgets, or just paying for things you didn’t budget for. However, if you’re finding that your bills are stacking up, your savings account is barely growing, or you’re feeling stressed about money, it might be time to take a step back and think about where things are going wrong. If you’re spending more than you earn, there’s a good chance you’re heading down a dangerous path.

Before you panic, know that you’re not alone, and there are steps you can take to get back on track. If you’re feeling overwhelmed with debt—maybe from things like private student loan consolidation or other financial obligations—it’s essential to recognize the warning signs that you’re living beyond your means. Let’s break down five signs that you need to make a course correction before things spiral out of control.

- Your Bills Are Piling Up

One of the clearest signs that you’re spending more than you earn is when bills start to pile up and you find yourself struggling to pay them on time. It’s easy to put things off or hope the money will show up before the due date, but constantly having overdue bills is a major red flag. If you’re regularly relying on credit cards or loans to cover expenses, that’s a big signal that your spending is out of balance with your income.

While credit cards can offer a temporary solution, they often come with high-interest rates that make it harder to pay off your debt in the long run. You may also find yourself borrowing from one card to pay another, digging yourself deeper into a financial hole. It’s important to confront this problem before it gets worse—whether that means cutting back on spending or exploring options like private student loan consolidation or debt consolidation to make your payments more manageable.

- Your Savings Account Isn’t Growing

If you’re putting money into savings but still feel like it’s never enough, or worse, you aren’t saving at all, it’s time for a reality check. Ideally, you should aim to save a portion of each paycheck, even if it’s just a small amount. Not having savings means you’re at risk of not having enough money to cover emergencies like medical bills, car repairs, or unexpected expenses. Without a financial cushion, you’re more likely to fall deeper into debt.

If you’re finding it difficult to set aside money for savings, look at where your money is going. Are there subscriptions you don’t need? Expensive habits you can cut back on? By analyzing your spending habits, you might discover areas where you can cut back and redirect that money into savings. Setting up automatic transfers to your savings account as soon as you get paid can also make it easier to save consistently.

- You’re Using Credit Cards to Cover Daily Expenses

Using credit cards for everyday expenses can be a slippery slope, especially if you don’t pay off the balance each month. If you’re regularly using credit cards to cover essentials like groceries, gas, or even rent, it’s a sign that your income isn’t stretching as far as it needs to. Eventually, your credit card balance will grow, and you’ll be stuck paying off interest and fees. Over time, this can snowball into a serious financial burden.

If this sounds familiar, it’s important to take a step back and assess why you’re relying so heavily on credit cards. Do you need to adjust your spending habits, or is it time to rethink your budget altogether? The longer you let this go on, the harder it will be to get your finances under control. Sometimes, consolidating high-interest credit card debt or considering options like private student loan consolidation can help reduce the overall debt load and make your payments more manageable.

- You’re Living Paycheck to Paycheck

Living paycheck to paycheck can feel like you’re constantly in a cycle of stress and uncertainty. It’s hard to make long-term plans when you’re unsure if you’ll have enough to cover your basic expenses each month. If you find yourself scrambling to make ends meet before the next paycheck comes in, it’s a sign that your spending is out of line with your income.

While some fluctuations in your finances are normal, living paycheck to paycheck on a regular basis often means that you’re overspending or that your income isn’t high enough to cover your needs. If you’re stuck in this cycle, it’s important to start looking at your spending habits and see where adjustments can be made. Creating a budget, setting aside an emergency fund, and finding ways to increase your income (such as picking up extra work or negotiating a higher salary) can help break the paycheck-to-paycheck cycle.

- You Feel Constantly Stressed About Money

One of the most obvious, yet often overlooked, signs that you’re living beyond your means is the constant stress that comes with money. If you’re constantly worried about bills, debt, and making ends meet, it’s a clear indication that something needs to change. Money stress can affect every area of your life, from your relationships to your health, so it’s important to address the root causes of this anxiety.

Take the time to assess why you’re feeling this stress. Is it because you’re overspending on things you don’t need? Is it because you’ve accumulated too much debt, and the weight of it is crushing you? Whether it’s cutting back on unnecessary expenses or seeking professional help, like credit counseling or a consolidation loan, addressing the source of your financial anxiety can help you regain control and peace of mind.

Taking Control and Moving Forward

If you’re reading this and realizing that some of these signs hit close to home, don’t panic. Recognizing that you’re spending more than you earn is the first step toward making positive changes. The good news is that you can start turning things around right now.

Here are some steps to get started:

- Track your spending: Start by tracking every dollar you spend for a month. This will give you a clear picture of where your money is going and help you identify areas to cut back.

- Create a budget: Set up a budget that allows you to cover your basic expenses, pay down debt, and set aside money for savings.

- Look into debt consolidation options: If debt is part of the problem, a consolidation loan could help you combine multiple payments into one, making it easier to manage.

- Cut back on non-essential spending: Focus on needs rather than wants, and look for ways to reduce your monthly expenses.

- Increase your income: If possible, look for ways to bring in extra money, such as taking on a side job or asking for a raise at work.

Taking control of your finances starts with small, manageable changes. By addressing the signs early on, you can prevent financial problems from getting worse and set yourself on a path toward greater financial stability.

Final Thoughts

Spending more than you earn can be a difficult cycle to break, but it’s important to recognize the signs before it gets out of hand. By evaluating your financial habits, cutting back on unnecessary expenses, and making smarter choices, you can regain control of your money. If needed, explore options like private student loan consolidation or other debt management strategies to help you get back on track. The key is to act now before things spiral further. Remember, financial freedom is within your reach—you just need to take the first step.

-

GENERAL1 year ago

GENERAL1 year agoDiscovering the Artistic Brilliance of Derpixon: A Deep Dive into their Animation and Illustration

-

Posts1 year ago

Posts1 year agoSiegel, Cooper & Co.

-

Lifestyle1 year ago

Lifestyle1 year agoPurenudism.com: Unveiling the Beauty of Naturist Lifestyle

-

Lifestyle1 year ago

Lifestyle1 year agoBaddieHub: Unleashing Confidence and Style in the Ultimate Gathering Spot for the Baddie Lifestyle

-

HEALTH1 year ago

HEALTH1 year agoTransformative Health Solutions: Unveiling the Breakthroughs of 10x Health

-

Entertainment1 year ago

Entertainment1 year agoKhatrimaza Unveiled: Exploring Cinematic Marvels and Entertainment Extravaganza

-

Entertainment1 year ago

Entertainment1 year agoGeekzilla Podcast: Navigating the World of Pop Culture, Gaming, and Tech

-

BUSINESS1 year ago

BUSINESS1 year agoUnlocking the Secrets to Jacqueline Tortorice Remarkable Career and Accomplishments