GENERAL

Effortless Credit Card Cashing Methods You Should Know

Managing your finances efficiently often involves finding creative solutions for accessing cash when you need it most. One such method is cashing out your credit card. Whether it’s paying off unexpected bills or making a large purchase, credit card cashing can help meet your needs. However, understanding the methods and potential costs involved is essential to make an informed decision.

Introduction to Credit Card Cashing

Cashing out your credit card can be a quick way to access funds in emergencies or for financial flexibility. Whether it’s paying off unexpected bills or making a large purchase, credit card cashing can help meet your needs. However, understanding the methods and potential costs involved is essential to make an informed decision.

What is Credit Card Cashing?

Credit card cashing refers to the process of converting your credit card limit into liquid cash. This is typically done through a cash advance or by utilizing third-party services that allow you to exchange your credit for cash. While it can be convenient in urgent situations, it’s important to understand how the process works and the potential costs involved, such as high fees and interest rates.

Why People Choose Credit Card Cashing

Many individuals choose credit card cashing for various reasons 신용카드 현금화, such as emergency expenses, short-term liquidity needs, or avoiding long loan approval processes. It offers a fast and relatively easy way to get money when other options might take too long. Credit card cashing provides a financial cushion during urgent situations, making it a useful tool for people who need immediate funds.

Step 1: Understanding Credit Card Cashing Methods

There are several ways to cash out your credit card. Each method has its pros, cons, and associated fees. Let’s explore the main ways to convert your credit into cash.

Cash Advance from Your Credit Card

A cash advance is one of the most common ways to access cash from your credit card. It involves withdrawing funds from your credit card’s available credit limit. You can usually access these funds through ATMs or by visiting a bank branch. However, cash advances come with higher fees compared to regular credit card purchases. The interest rates tend to be higher, and interest starts accruing immediately, with no grace period.

Using Third-Party Platforms for Cashing

Another method involves using third-party platforms that facilitate cashing out credit cards. These platforms connect you with buyers or lenders willing to exchange cash for your available credit. The benefit of using these services is that they can offer competitive rates, but there may still be processing fees and risks associated with choosing an unverified platform. Always research and select a reliable, secure service to avoid scams.

Selling or Pledging Your Credit

A less common but emerging method involves selling or pledging your credit. This may include transferring your available credit to someone else in exchange for immediate cash, or it could involve using your credit card as collateral. While it can be a quick way to access funds, it carries certain risks, especially if you’re not familiar with the process or if the agreement isn’t clear.

Step 2: Choosing the Right Method for You

Once you understand the available methods for cashing out your credit, it’s time to choose the best approach for your situation. There are several factors to consider, such as fees, speed, and security.

Consider the Fees and Interest Rates

One of the most important considerations when choosing a method for cashing out is understanding the associated costs. Cash advances typically have high fees and immediate interest charges, making them less cost-effective in the long term. Third-party platforms may charge processing fees, but some may offer lower rates or a more flexible approach. Be sure to compare the total cost, including any hidden fees, before making your decision.

Evaluate the Speed and Convenience

Speed and convenience are key when you need quick access to cash. Cash advances are often immediate, and you can access funds through ATMs or bank branches. However, they may come with higher costs. Third-party services may take a little longer to process the transaction, but they can provide more competitive rates. In-person transactions (like selling or pledging your credit) can also be quick, but they may not be as reliable or secure.

Security and Safety Concerns

When cashing out your credit card, it’s essential to prioritize security. Cash advances from reputable financial institutions are typically safe, but third-party platforms and selling your credit come with risks. Always ensure that you’re using a trusted and secure platform, and never share sensitive financial information with unknown entities.

Step 3: Finalizing the Cashing Process

Once you’ve selected the best cashing method, it’s time to finalize the transaction. This stage involves receiving your funds and managing the repayment process.

Receiving Your Funds

For cash advances, you can either withdraw money from an ATM or request a bank transfer to your account. With third-party platforms, funds are often sent via bank transfer or PayPal. Make sure to verify the payment method and ensure it is convenient for you. Some services may offer faster payment options, while others could take a few days.

Paying Off Your Credit Card

It’s important to keep track of your credit card balance after cashing out. Make timely payments to avoid interest from accumulating on the cash advance. Since cash advances typically have high-interest rates, repaying the amount as soon as possible will help you minimize the financial impact.

Tips for Minimizing Costs

To minimize the costs associated with cashing out, consider paying off your balance quickly and only using cash advances or third-party services when absolutely necessary. Some credit cards offer lower interest rates for cash advances, so choosing the right card can help. Additionally, carefully reviewing the terms and conditions of third-party services will ensure that you aren’t surprised by hidden fees.

Pros and Cons of Cashing Out Gift Cards

Pros:

- Immediate Access to Cash: Cashing out gift cards provides quick access to funds, which is particularly useful in emergencies when you need money fast.

- Flexibility: Unlike store-specific gift cards, cashing them out gives you access to funds that can be used for anything, not just the retailer where the card was issued.

- Convenience: Online platforms allow you to cash out gift cards from the comfort of your home, with the option to receive cash via bank transfer, PayPal, or prepaid cards.

- Avoid Unused Balances: If you have unused gift cards lying around, cashing them out ensures that the money is put to use rather than being wasted.

Cons:

- Fees: Some platforms charge fees for cashing out gift cards, reducing the amount of money you’ll receive. These fees can range from flat rates to percentage-based charges.

- Lower Payouts: Depending on the platform and card type, the payout you receive for your gift card may be less than its face value, especially if you’re using a third-party service.

- Scams and Fraud: There are fraudulent platforms that may scam users. Always ensure you’re using a reputable service with good reviews and clear terms.

- Limitations on Card Types: Not all gift cards are eligible for cashing out, and some platforms may only accept cards from specific brands or retailers, limiting your options.

Frequently Asked Questions (FAQ)

- What types of items are best for second-hand sales?

Electronics like smartphones, tablets, and gaming consoles often have a high resale value. Furniture, especially from well-known brands, can also fetch a good price. Designer clothing, shoes, and accessories are other profitable categories, along with collectibles such as vintage items and limited-edition products. - How do I know the value of my second-hand item?

To assess the value of your item, research similar listings on online platforms like eBay or Facebook Marketplace. Look at the condition of your item and compare it to others in the same category. Be sure to check whether your item has any special features or is in high demand, as this can increase its value. - How can I make my listing more attractive to buyers?

Take clear, well-lit photos from different angles, highlighting any features and imperfections. Write a detailed description with accurate information about the item’s condition, brand, and specifications. Be honest and transparent to build trust with potential buyers. - Are there any risks when selling second-hand items?

Yes, there can be risks, especially with online sales. Be cautious of scams and ensure you use secure payment methods. For local sales, always meet in a public place and avoid sharing personal details. Using platforms with buyer and seller protections can also help reduce risks. - How can I maximize the price I get for my second-hand goods?

Price your items competitively by researching similar products. Consider offering discounts for multiple items or negotiating with buyers. Timing your sale during peak demand periods can also help you get better prices, such as selling holiday items after the season.

Conclusion

In conclusion, cashing out your credit card can be a practical solution for accessing funds quickly, but it’s important to choose the right method. Whether through a cash advance, third-party platform, or selling your credit, each method comes with its own set of fees, risks, and benefits. To minimize costs, always compare fees, understand the terms, and prioritize secure transactions. By following these steps and making informed decisions, you can unlock cash from your credit card in a way that best suits your financial needs while minimizing potential drawbacks.

GENERAL

Driving the Future: How Data Science, AI, and EV Education are Powering Innovation

In today’s rapidly evolving digital world, technological innovation is reshaping industries and redefining how businesses operate. Among the most transformative forces are data science and artificial intelligence, which are not only streamlining operations but also uncovering new business opportunities. Simultaneously, the global push for sustainability has accelerated the adoption of electric vehicles (EVs), creating a growing demand for talent skilled in EV technology and infrastructure. This convergence of advanced tech and green innovation signals an exciting future, especially for those willing to skill up through specialized courses like AI programs and EV course offerings.

The Power of Data Science and Artificial Intelligence

At the core of digital transformation lies data science and artificial intelligence. Data science allows organizations to extract actionable insights from massive datasets, while AI leverages those insights to simulate human intelligence in machines — enabling automation, prediction, and personalization on an unprecedented scale.

From personalized recommendations on streaming platforms to fraud detection in banking, these technologies are already deeply embedded in our daily lives. Businesses are increasingly recognizing the power of these tools to reduce costs, improve customer experience, and gain a competitive edge.

Moreover, the synergy between data science and AI has led to remarkable advances in fields such as healthcare, supply chain, finance, and education. Predictive analytics is helping doctors make quicker, more accurate diagnoses. Logistics companies are optimizing delivery routes in real-time. And educational institutions are customizing learning paths based on student behavior and progress.

The applications are virtually limitless — and growing.

AI for Business: Unlocking Smarter Decision-Making

Incorporating ai for businessai for business is no longer a futuristic concept — it’s a necessity. Businesses today are leveraging AI not just for automation but for enhancing decision-making processes, forecasting trends, and personalizing customer engagement.

Take customer service, for instance. AI-powered chatbots now handle a vast volume of customer inquiries with accuracy and speed, freeing up human agents for more complex queries. In marketing, AI tools analyze consumer behavior and generate tailored campaigns that resonate more deeply with target audiences. Even in HR, AI is helping organizations identify the best candidates through intelligent resume screening and predictive hiring models.

Beyond operations, strategic AI implementation enables businesses to analyze market data and identify emerging opportunities, helping leaders make informed decisions swiftly. For small- and medium-sized enterprises (SMEs), this levels the playing field by providing access to insights and capabilities that were previously exclusive to large corporations with significant R&D budgets.

The integration of AI across business functions signals a clear shift: data is the new oil, and AI is the engine driving growth.

Preparing for a Sustainable Future: The Rise of the EV Industry

While AI and data are revolutionizing business, another crucial shift is happening on the roads. The global push toward sustainable transportation has made electric vehicles (EVs) a cornerstone of the green revolution. With governments offering incentives, manufacturers expanding EV lines, and consumers showing growing interest, the EV industry is poised for exponential growth.

However, this surge demands a skilled workforce — and that’s where an ev course becomes crucial.

EVs are not just about replacing gasoline with electricity. They encompass an entire ecosystem: battery technology, charging infrastructure, power electronics, energy management, and more. Professionals with specialized knowledge in these areas are in high demand, from automotive engineers and energy consultants to data analysts focused on EV efficiency and sustainability metrics.

Pursuing an ev course equips individuals with technical know-how and practical insights into EV design, manufacturing, and deployment. These programs also often cover crucial topics such as battery thermal management, electric drivetrains, and vehicle integration with renewable energy systems.

The bottom line? Those who gain expertise in EVs will not only contribute to a greener planet but also secure a future-ready career.

The Intersection: AI and Data Science in the EV Revolution

Interestingly, the connection between AI, data science, and EVs is becoming stronger by the day. Smart vehicles, including EVs, now come equipped with sophisticated AI-driven systems that manage everything from route optimization to predictive maintenance.

Data science plays a vital role here — collecting and analyzing driving behavior, battery performance, and energy usage patterns to improve EV design and user experience. AI helps make sense of this data in real time, allowing for autonomous driving capabilities, adaptive cruise control, and advanced driver-assistance systems (ADAS).

Additionally, as smart cities develop, EVs will communicate with urban infrastructure, traffic systems, and energy grids. This complex network will be powered by AI algorithms and vast data flows, requiring professionals who understand both data science and artificial intelligence and the nuances of EV technology.

Why Now is the Time to Upskill

Whether you’re a working professional looking to stay relevant, a student planning your career, or an entrepreneur seeking to innovate, this is the perfect moment to upskill in these high-demand domains. Educational institutions and online platforms are increasingly offering comprehensive programs that cover ai for business, core data science concepts, and cutting-edge ev course curricula.

These courses are designed to be industry-relevant, often in collaboration with top universities and corporations, ensuring that learners gain practical skills that can be immediately applied. Many programs offer hands-on experience through capstone projects, case studies, and real-world simulations — preparing you not just for the job market but for innovation and leadership.

Moreover, with the availability of hybrid and flexible learning options, upskilling has never been more accessible.

Conclusion

The convergence of data science and artificial intelligence, ai for business, and electric vehicle technologies represents a new era of opportunity. These domains are not only driving innovation but also shaping the global economy and our collective future.

By investing in the right education — be it an AI specialization, a business-focused AI program, or an in-depth EV course — you position yourself at the forefront of this transformation. You gain the tools to contribute meaningfully to industries that matter, solve problems that impact millions, and build a career that’s both future-proof and fulfilling.

In a world where change is the only constant, the best strategy is to stay curious, stay informed, and most importantly, stay prepared.

GENERAL

Unlocking Success with uti.blackboard: The Comprehensive Guide

In the era of digital transformation, uti.blackboard has emerged as a leading learning management system (LMS) that revolutionizes online education. Whether you’re an instructor designing courses or a student navigating assignments, uti.blackboard offers a robust platform for delivering and managing content efficiently. This guide will walk you through the essential aspects of uti.blackboards, from its core capabilities and setup process to best practices and troubleshooting advice. By the end, you’ll have the insights needed to harness the full power of uti.blackboards, enhance engagement, and streamline your workflow. Let’s dive into how uti.blackboards can elevate the learning experience for everyone involved.

What Is uti.blackboard?

uti.blackboard is a cloud-based LMS designed to centralize course content, communication, and assessment in one intuitive environment. Developed for educational institutions and corporate trainers alike, uti.blackboards supports personalized learning paths, secure data handling, and seamless integration with third-party tools. Users can access lessons, submit assignments, and track progress from any device. With its flexible architecture, uti.blackboards adapts to diverse pedagogical models, making it a preferred choice for K‑12 schools, universities, and training organizations seeking to modernize instruction and improve learning outcomes.

Top Features of uti.blackboard

uti.blackboard offers a suite of features designed to enrich the online learning experience. Below, we highlight the most impactful capabilities that set uti.blackboards apart:

Course Management in uti.blackboard

Educators can create structured modules, upload multimedia content, and schedule assignments using an intuitive drag‑and‑drop interface. Real‑time notifications keep students informed of deadlines and course updates.

Communication Tools in uti.blackboards

Built‑in discussion boards, direct messaging, and live video conferencing foster collaboration and community. Learners can engage with peers and instructors, ask questions, and participate in group projects without leaving the platform.

Assessment and Analytics with uti.blackboards

Automated grading, customizable rubrics, and detailed performance dashboards allow instructors to monitor progress and identify areas for improvement. Analytics tools generate real‑time reports on engagement, completion rates, and learner success.

Mobile Learning on uti.blackboard

uti.blackboard also supports mobile learning, giving students on-the-go access to course materials, assignments, and grades through dedicated iOS and Android apps.

Getting Started with uti.blackboard

Embarking on your uti.blackboard journey begins with account registration and platform familiarization:

Account Setup on uti.blackboard

Visit your institution’s uti.blackboards portal and sign up with your official email. Customize your profile by adding a photo, contact details, and notification preferences. Enable two‑factor authentication for added security.

Navigating the uti.blackboards Dashboard

Once logged in, the uti.blackboard dashboard displays active courses, upcoming tasks, and recent announcements in customizable widgets. Use the sidebar menu to jump between course pages, gradebook insights, and calendar views. Quick-access links streamline content uploads, discussion postings, and grade entries.

If you prefer mobile access, download the dedicated uti.blackboards app to receive real‑time alerts and participate in virtual classrooms from your smartphone or tablet. Exploring tutorial videos and help documents within the platform can further accelerate your proficiency in using key features of uti.blackboards.

Best Practices for uti.blackboard Implementation

Maximizing the benefits of uti.blackboards requires strategic design and active engagement strategies:

Designing Engaging Content with uti.blackboard

Break lessons into concise modules, embed multimedia elements like videos and interactive quizzes, and maintain consistent formatting. Use the uti.blackboard content editor to create accessible materials with alt text and headings.

Fostering Collaboration in uti.blackboard

Encourage peer interactions by setting up group assignments, discussion threads, and peer‑review activities. Schedule synchronous sessions via uti.blackboard’s virtual classroom feature to simulate live instruction and Q&A.

Additionally, establish clear communication guidelines—such as weekly announcements and feedback timelines—to keep learners motivated. Regularly review analytics in uti.blackboards to identify low-engagement areas and refine your approach.

Troubleshooting Common Issues in uti.blackboard

Even the most robust systems can encounter hiccups. Here’s how to address frequent challenges with uti.blackboard:

Login and Access Challenges on uti.blackboard

If you can’t access your account, verify your credentials, clear your browser cache, or try an alternate supported browser. Use the “Forgot Password” link to reset credentials, and check spam folders for reset emails.

Uploading Content Errors in uti.blackboard

Large files may exceed upload limits; compress videos or split documents into smaller segments. Ensure file formats are compatible (e.g., MP4 for video, PDF for documents) before uploading. If you receive error messages, contact your admin to verify server status and storage quotas.

For issues with grading or discussion forums, consult the uti.blackboard support center or engage with community forums for peer‑driven solutions.

Advanced Tips and Future Trends for uti.blackboard

Administrators and power users can leverage advanced capabilities in uti.blackboard to stay ahead:

-

LTI Integrations: Connect tools like Zoom for virtual classes or Turnitin for plagiarism checks.

-

REST APIs: Automate tasks such as user provisioning and data extraction.

-

Custom Branding: Tailor the look and feel of your uti.blackboards environment with institutional logos, color themes, and navigation menus.

Looking forward, uti.blackboard is exploring AI‑driven personalization, smart content recommendations, and enhanced proctoring solutions. Staying current with platform updates and participating in beta programs ensures you adopt cutting‑edge features as they roll out.

Conclusion

uti.blackboard has become an indispensable LMS for modern educators and learners, offering a unified space for course delivery, engagement, assessment, and analytics. By understanding the platform’s core functions, exploring its top features, and following best practices for content design and collaboration, users can optimize their digital learning environments. Addressing common technical challenges with simple troubleshooting steps keeps courses running smoothly, while advanced integrations and future AI enhancements promise to elevate the utility of uti.blackboard even further. Whether you’re launching your first online course or overseeing a large‑scale implementation, uti.blackboards provides the flexibility, security, and scalability necessary for success. Embrace the full capabilities of uti.blackboards today to create more engaging, efficient, and impactful learning experiences for all participants.

GENERAL

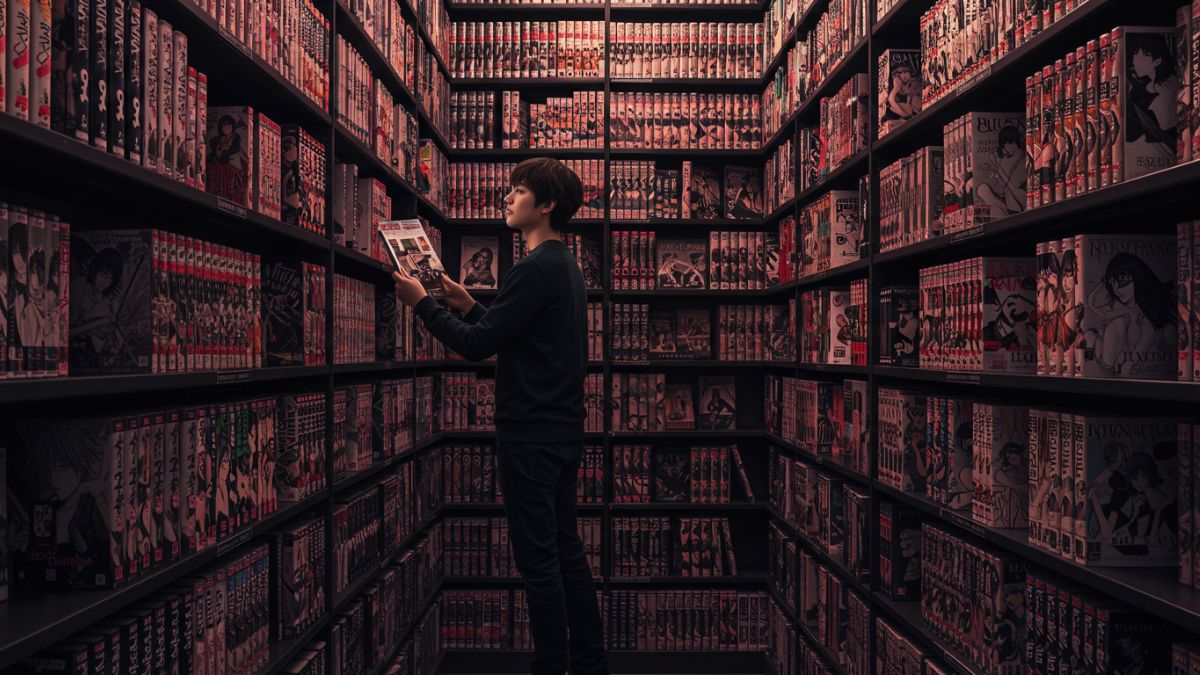

Hentaifox: Exploring the Digital Library of Adult Manga Content

In today’s digital age, manga readers have access to an incredible range of content through online platforms. Among the many websites available, Hentaifox has become a popular choice for fans seeking adult-themed manga. With a vast archive of titles and an interface that prioritizes ease of use, this platform has carved out its space in the online manga community.

This article will guide you through the essentials of Hentaifox — what it is, how it works, what makes it unique, and how users can safely browse the site.

Understanding Hentaifox: A Manga Reader’s Platform

Hentaifox is an online platform primarily focused on adult-oriented manga. It offers free access to thousands of titles that span across numerous genres and themes. The platform is well-known for its comprehensive tag system, which allows readers to explore content according to their specific interests.

Unlike some manga websites that host a mix of content types, Hentaifox specializes specifically in hentai manga. This clear focus gives it a niche edge and a dedicated audience base that returns frequently for updates and new content.

Key Features That Define Hentaifox

Hentaifox is more than just a manga database — it’s a user-centric platform that emphasizes readability and convenience. Here are some features that stand out:

1. Clean Layout and Interface

The site is structured in a way that allows smooth browsing, even for first-time visitors. Manga titles are presented in a grid layout with cover previews, making it easier to choose what to read.

2. Tag and Category Filters

Hentaifox features a detailed tagging system. Whether users are looking for something romantic, comedic, dark, or supernatural, the tags help narrow down search results.

3. Large Manga Library

With thousands of manga volumes and one-shots, the platform continues to expand its library. Content is available in multiple languages, making it accessible to a global audience.

4. Bookmark and Reading History Options

Registered users can bookmark titles and track their reading history. This is particularly helpful for ongoing series or revisiting old favorites.

Why Manga Readers Choose Hentaifox

Hentaifox has become a go-to source for adult manga due to several key advantages over competing platforms. Here’s why readers keep coming back:

Regular Content Updates

The platform is frequently updated, with new manga added almost daily. This ensures that users have a fresh flow of content every time they visit.

Optimized for Mobile Devices

Hentaifox is designed to work well on smartphones and tablets, making reading on the go a smooth experience.

Community-Based Suggestions

Many users provide reviews or comments on manga titles. These insights often help others decide what’s worth reading or skipping.

Is Hentaifox Safe to Use?

When visiting any adult-themed website, it’s essential to take precautions to protect your device and data. Here are some smart practices for browsing Hentaifox safely:

Use a VPN

Using a virtual private network can hide your IP address and help protect your browsing activity, especially when accessing content-sensitive websites.

Install a Reputable Ad Blocker

Although Hentaifox has fewer ads than many adult platforms, an ad blocker can minimize distractions and prevent unwanted pop-ups.

Avoid Downloading Unofficial Files

Stick to online reading. Downloading files from unverified sources may carry the risk of malware or spyware.

Keep Your Browser Updated

Make sure your browser is up to date to benefit from the latest security patches and performance improvements.

Hentaifox vs. Other Manga Platforms

There are several manga websites out there, but Hentaifox stands out in its niche. Here’s a quick comparison:

| Feature | Hentaifox | nhentai | Doujins.com |

|---|---|---|---|

| Specialization | Hentai Manga | Hentai/Doujin | Short-form Doujinshi |

| User Interface | Simple & Clean | Minimal | Media-heavy |

| Tag Navigation | Yes | Yes | Limited |

| Mobile Optimization | Excellent | Good | Decent |

Hentaifox’s clean and categorized layout makes it easier for users to explore without feeling overwhelmed.

Supporting Creators and Ethical Use

While Hentaifox offers free access to thousands of titles, it’s worth mentioning the importance of supporting original creators. Many manga artists work hard to produce content, and buying official releases when available helps sustain the industry.

It’s also crucial to verify that the content being consumed is appropriate and legally hosted. Using ethical platforms and supporting legal manga publications ensures the long-term health of the industry.

Final Thoughts on Hentaifox

For adult manga fans, Hentaifox offers an accessible, easy-to-use, and content-rich platform. With its regularly updated collection, well-organized tags, and user-friendly features, it provides a tailored experience for those interested in this specific genre of manga.

However, responsible browsing is key. Always take safety measures, respect age restrictions, and consider supporting the creators whose work you enjoy. By doing so, you can enjoy the best Hentaifox has to offer while contributing positively to the manga community.

-

GENERAL1 year ago

GENERAL1 year agoDiscovering the Artistic Brilliance of Derpixon: A Deep Dive into their Animation and Illustration

-

Posts1 year ago

Posts1 year agoSiegel, Cooper & Co.

-

Lifestyle1 year ago

Lifestyle1 year agoPurenudism.com: Unveiling the Beauty of Naturist Lifestyle

-

Lifestyle1 year ago

Lifestyle1 year agoBaddieHub: Unleashing Confidence and Style in the Ultimate Gathering Spot for the Baddie Lifestyle

-

HEALTH1 year ago

HEALTH1 year agoTransformative Health Solutions: Unveiling the Breakthroughs of 10x Health

-

Entertainment1 year ago

Entertainment1 year agoGeekzilla Podcast: Navigating the World of Pop Culture, Gaming, and Tech

-

Entertainment1 year ago

Entertainment1 year agoKhatrimaza Unveiled: Exploring Cinematic Marvels and Entertainment Extravaganza

-

BUSINESS1 year ago

BUSINESS1 year agoUnlocking the Secrets to Jacqueline Tortorice Remarkable Career and Accomplishments