Finance

Navigating Financial Accuracy: How a Budget vs Actual Dashboard Can Guide Your Business

Introduction to Budget vs Actual Dashboards

What is a Budget vs Actual Dashboard?

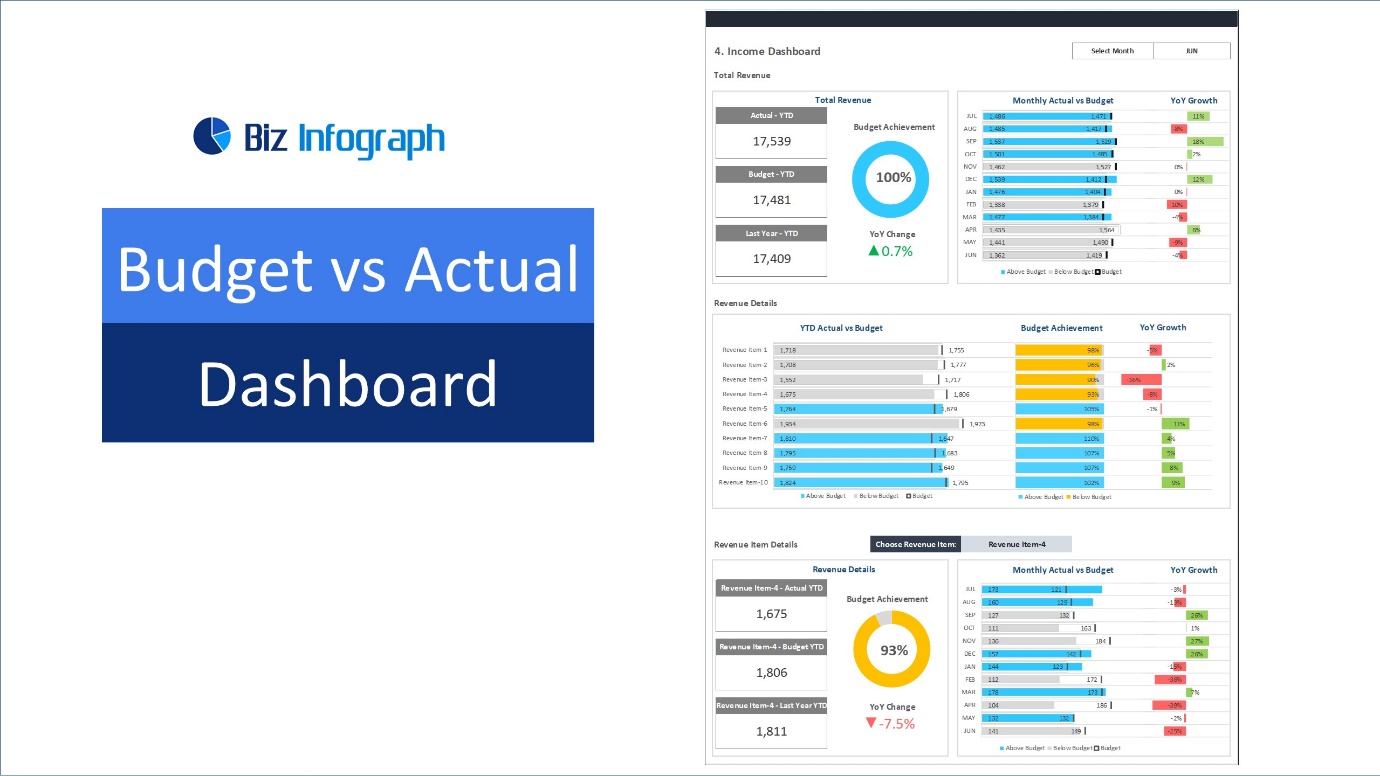

A budget vs. actual is a tool, in the form of a chart or graph, that compares the planned budget allocation for an initiative or project against the historical spending on the project. Thus, budget vs. actual dashboards will help easily track whether projects remain within the budget and whether they will exceed costs to complete the project. Budget dashboards can also be a part of the project review; knowing which projects were over budget and why can help when setting the budget for the next project. Budget vs Actual Dashboard: Track, analyse, and manage financial performance with precision.

The Importance of Financial Accuracy in Business

Suppose a financial information has been gathered and disclosed appropriately and uniformly within a certain period. In that case, such a message indicates that the business performance within this duration can be ascertained to allow leaders to analyze aspects such as the change in taxes or hike in raw materials prices. This, in turn, can flow into strategy formulation.

Key Features of a Budget vs Actual Dashboard

Real-Time Tracking of Financial Performance

A budget-to-actual statement compares actual spending with the planned budget in real-time. The elements include real-time graphs and charts that display deviations, expenses and revenues analysis, and notifications on large deviations. This makes it easy to remove or add specific strategies to achieve the best aims or financial objectives on target.

Visualization Tools and Their Benefits

Charts, graphs, and heatmaps are visualization tools that help us understand complex data. They draw trends, show patterns, make comparisons more accessible, and improve our ability to understand and make decisions. These tools are helpful for purposes in that they make it easier to gain information, spot issues, communicate findings to those above us, and strategize.

Customizable Alerts for Budget Deviations

Flexible variations of budget reports inform users of significant disparities from planned budget values. Such alerts may be set by quantifiable measures, such as when a specific budget has been surpassed or perhaps due to some unusual expenditure activity. In particular, timely notification lets us address the identified problems in time, make the needed changes, and gain some financial control to meet the budgets efficiently.

Benefits of Using a Budget vs Actual Dashboard

Enhanced Decision-Making Capabilities

A Budget vs. Actual dashboard aids in arriving at sound decisions, especially when comparing the budgeted figures and the actual financial results. It helps in the timely detection of deviations, points out the areas requiring focus, and aids in making changes based on numerical values. The real-time information assists the managers in making appropriate decisions. Therefore, resource utilization is controlled, and general business performance is enhanced.

Improved Financial Planning and Analysis

Flexibility is attained through the implementation of a Budget vs. Actual dashboard that presents the financial budget and performance trends. Thus, it will grant a certain level of awareness, which in turn provides the possibility for more precise estimations of the necessary resources and their reallocation, thus resulting in effective financial activity and improved long-term planning.

Identifying Trends and Potential Savings

A Budget vs. Actual dashboard assists with trends and possible savings by comparing actual and budget values. Reviewing such factors exposes numerous irregularities that define excessive expenditure, making it easier to identify potential areas of cuts and proper resource appropriation to enhance effectiveness in managing resources, hence cutting costs.

Implementing a Budget vs Actual Dashboard

Initial Setup and Data Integration

It is essential to know that while adopting a Budget vs. Actual dashboard, specific key performance indicators should be established with the related finance data feeds. The input data should be collected correctly from accounting systems or spreadsheets, and the dashboard should be adjusted to include essential budgeting forecasts and actual costs. Data must be updated frequently. Therefore, proper schedules for refreshing the data should be estimated to have updated and more accurate results when the analysis is conducted.

Training Staff and Promoting Adoption

The stakeholders should explain to the staff how to use the Budget vs. Actual dashboard using practical demonstrations and tutorials. They should stress its importance and relevance to financial analysis and possible financial decisions. This can be done through one-ring performance improvement that illuminates the benefits of adoption in terms of efficiency and accuracy. Ensure that support is offered in the future and feedback provided to guarantee that the tools are effectively integrated into the financial management practices being followed in the institution.

Best Practices for Maintaining Dashboard Accuracy

Keep the dashboard data current so that the source data underlying the dashboard is clean and proficient. Some of the best practices that can be recommended include updating data in an automated manner to enable users to work with real-time information. It is good practice to check and modify the dashboard metrics and filter settings occasionally. Further, staff training is required to reduce the chances of users making mistakes and establish a procedure for dealing with inconsistent data.

Overcoming Challenges with Budget vs Actual Dashboards

Addressing Common Data Inconsistencies

Another recommendation to avoid difficulties in using Budget vs. Actual dashboards is to ensure efficient integration and data quality in Budgeting/Actual data gathering and incorporation from all sources. Introduce validation points to check for these inconsistencies and apply the correction if needed. Make data synchronizations to compare the two systems frequently and modify the dashboard parameters given the recent changes in the accounting rules or business procedures. This ensures that only credible data that could be of significant use is collected and processed over some time.

Ensuring user engagement and data literacy

It guarantees an active interest from the users and fluency in data with the training of the core abilities of the dashboard and data analysis. Explain how the product will be used regularly with the help of examples based on everyday usage and relevant situations. Encourage the use of analytics by promoting a culture that uses its insights for decisions and assisting to enhance the users’ knowledge when using the dashboard.

Technology Considerations and Solutions

If an organization is to use a Budget vs. Actual dashboard, it should look for technology add-ons that provide integration capabilities, live status, and capacity to expand. Select systems that enable easy usage and good graphical representations. Integration with current systems is necessary; security is also essential, particularly regarding money information. Sometimes, business needs require flexibility and the possibility to adjust the infrastructure quickly; in other cases, the focus is on more control over the environment; therefore, compare cloud and on-premises solutions depending on your company’s requirements.

The Future of Financial Dashboard

Evolving Technologies in Budget Monitoring

The emergence of such technologies as AI and machine learning will further define the development of financial dashboards in terms of predictive and automated insights. Data acquisition and usage in real-time and incorporating cloud technology will be more flexible and expandable solutions. With improved techniques in visualization and effective Biz Infograph business dashboards will become more logical, providing more profound financial analysis results and improved strategic decision-making.

Predictive Analytics and Forecasting

Business intelligence optimization improves the performance of financial dashboards by employing data and statistical models to estimate future trends. This allows the formulation of strategies that help business organizations forecast their likely financial performance and the risks involved and take early corrective measures if necessary. With the help of these techniques, dashboards can give better forecasting and intelligent information about business executives, which will help in strategic management and better resource utilization.

The Growing Importance of Financial Dashboards in Strategic Planning

Budget, financial, and other analytic quick reference tools or customizable financial ‘tickers’ are becoming critical in strategic planning as they provide instantaneous current status of a business’s performance and economic conditions. Thus, they help to make effective decisions, to monitor the achievement of organizational objectives, and to make necessary changes on time. This improves the company’s strategic operations by giving a precise idea of how the financial aspect would be planned and managed to fit the longer-term plans and market trends.

Conclusion

Budget tracking tools, particularly dashboards, are thus very important in confirming compliance with financial accuracy in the organization since they deliver a timely, graphic portrayal of the difference between the budget and the actual. These formats draw attention to differences and patterns, helping prepare businesses for changes and make better decisions. An ongoing practice is needed to update the data source, improve the metrics, and use technologies to avoid discrepancies. Training and feedback also enhance the efficiency of financial monitoring in decision-making and its correspondence with the evolving goals of the organization.

Finance

Understanding qlcredit: Your Comprehensive Guide to Financial Freedom

Enter QLCredit—a tool designed to demystify your credit score and empower you on your journey toward financial freedom. Whether you’re looking to buy a home, secure a loan, or simply improve your financial health, knowing how QLCredit works is key. This guide will break down everything you need to know about QLCredit, from its importance in managing your finances to practical tips for boosting your credit score. Let’s dive in and take control of our financial futures together!

What is QLCredit?

QLCredit is an innovative platform designed to simplify credit management for individuals. It provides users with a clear view of their credit score and the factors influencing it.

At its core, QLCredit aggregates data from various credit bureaus, allowing you to track your score in real time. This means no more guessing games about where you stand financially.

The platform also offers personalized insights and recommendations tailored to your specific situation. Whether you’re building credit from scratch or recovering from past mistakes, QLCredit can guide your journey.

Additionally, users can access educational resources that demystify complex financial concepts related to credit scores and reports. Understanding these elements is crucial for making informed decisions about loans, mortgages, and other financial products.

Why is it important to understand your credit?

Understanding your credit is crucial for many aspects of financial health. Your credit score influences loan approvals, interest rates, and even rental agreements. It acts as a key to accessing better financial opportunities.

A solid grasp of your credit allows you to make informed decisions. You can identify areas needing improvement and take proactive steps toward enhancing your score. This knowledge empowers you when negotiating terms with lenders or service providers.

Moreover, being aware of your credit helps you avoid pitfalls like identity theft or unexpected drops in your score. Regularly monitoring it ensures that you’re not caught off guard by errors or fraudulent activities.

Understanding your credit provides clarity in managing finances effectively. It lays the groundwork for achieving long-term financial goals and security.

How does QLCredit work?

QLCredit operates as a personalized platform designed to track and manage your credit profile. By integrating advanced technology, it provides users with real-time updates on their credit scores.

The system pulls data from various credit bureaus to present a comprehensive view of your financial health. Users can access insights into what factors are influencing their score, such as payment history, utilization rates, and account types.

Furthermore, QLCredit offers tailored advice based on individual circumstances. This guidance helps in making informed decisions about budgeting and spending habits.

With its user-friendly interface, navigating through your financial information becomes seamless. Regular alerts keep you updated on significant changes that may affect your creditworthiness.

Utilizing QLCredit can empower individuals to take proactive steps towards improving their overall financial position while demystifying the complexities of traditional credit systems.

The benefits of using QLCredit

Using QLCredit can significantly enhance your financial journey. One of the standout benefits is its user-friendly interface. Navigating your credit profile has never been easier.

With QLCredit, you gain real-time access to your credit score and report. This transparency helps you make informed decisions about loans and other financial commitments.

Moreover, it provides personalized insights tailored to your unique situation. These recommendations enable users to understand their strengths and areas for improvement better.

The platform also offers monitoring services that alert you to any changes in your credit status. Staying on top of these developments allows for proactive management of potential issues.

QLCredit educates users on best practices for maintaining a healthy score, helping set the foundation for long-term financial stability. Embracing these advantages could pave the way toward greater financial freedom.

Tips for improving your credit score with QLCredit

Improving your credit score with QLCredit starts with understanding your current standing. Regularly check your credit report for errors. Dispute any inaccuracies you find; they can significantly impact your score.

Next, focus on paying bills on time. Late payments can lead to a drop in your score, so set up reminders or automate payments if necessary.

Keep credit utilization low by using less than 30% of your available credit limit. This shows lenders that you are responsible with borrowed money.

Consider diversifying your credit mix as well. A blend of revolving and installment accounts demonstrates financial reliability.

Avoid applying for multiple new accounts at once. Each hard inquiry can affect your score negatively, so space out applications to maintain stability throughout the process.

Common misconceptions about credit and QLCredit

Many people hold misconceptions about credit that can hinder their financial journey. One common belief is that checking your own credit score will negatively impact it. In reality, this is not the case. Self-checks are considered soft inquiries and do not affect your overall score.

Another myth is that carrying a balance on your credit card improves your score. This isn’t true; in fact, paying off balances in full each month shows responsible management and can boost your credit health.

Some also think that having no debt means a perfect credit score. While it’s beneficial to be debt-free, creditors often favor those with some history of managed debt because it demonstrates reliability.

There’s confusion surrounding QLCredit itself. Many assume it’s solely for loans or mortgages when it actually provides tools for monitoring and improving overall financial wellness, empowering users beyond just borrowing capabilities.

Conclusion:

Understanding qlcredit can be a game-changer when it comes to financial freedom. As you’ve learned, having good credit is essential for various aspects of your financial life. It influences loan approvals, interest rates, and even your ability to rent an apartment.

By utilizing QLCredit effectively, you can manage and improve your credit score over time. The platform provides tools that simplify the process of tracking and enhancing your credit health. With dedication and the right strategies in place, anyone can take control of their financial future.

Remember that myths about credit often lead people astray; staying informed is crucial. Whether it’s understanding how QLCredit functions or knowing what actions truly impact your score, knowledge empowers you on this journey.

Finance

Unlocking the Power of pasonet: A Comprehensive Guide

In a world where financial transactions are becoming increasingly digital, Pasonet stands out as a powerful tool that is transforming how we manage our money. This innovative payment platform has gained traction among users looking for secure and efficient ways to conduct their financial activities. Whether you’re sending money to friends or making online purchases, understanding the nuances of Pasonet can elevate your experience.

But what exactly is Pasonet? How did it come to be an integral part of the modern financial landscape? Join us as we delve into its rich history, explore the technology that powers it, and guide you through setting up your own account. We’ll also tackle common concerns surrounding this platform and discuss what lies ahead for Pasonet in the ever-evolving world of finance. Get ready to unlock the full potential of this remarkable service!

The History of Pasonet and its Evolution

Pasonet emerged in the early 2000s as a revolutionary digital payment platform. Its inception aimed to simplify transactions and improve financial accessibility for users worldwide.

Over the years, Pasonet has undergone significant transformations. Initially designed for basic money transfers, it quickly expanded its features to include bill payments and mobile top-ups. This evolution catered to a growing demand for versatile payment solutions.

With advancements in technology, Pasonet embraced secure encryption methods, ensuring user safety while fostering trust among customers. Partnerships with various merchants further enhanced its offerings, making online shopping seamless.

As competition grew within the fintech sector, Pasonet adapted by integrating artificial intelligence and machine learning capabilities. These innovations helped optimize transaction processes and provide personalized experiences based on user behavior.

Today, Pasonet stands as a testament to innovation in finance—a dynamic platform continually reshaping how we handle money digitally.

Understanding the Technology behind Pasonet

Pasonet operates on a cutting-edge technology framework that enables seamless financial transactions. At its core, the system utilizes advanced encryption protocols to ensure security and privacy for users.

The backbone of Pasonet’s infrastructure is built on blockchain technology. This decentralized approach not only enhances transparency but also reduces the risk of fraud. Every transaction is recorded in real-time, creating an immutable ledger accessible by all authorized parties.

Another key aspect is the integration of artificial intelligence. AI algorithms analyze user behavior to improve service offerings and detect anomalies in transactions swiftly.

Additionally, Pasonet leverages cloud computing for scalability and efficiency. This allows it to handle large volumes of transactions without compromising speed or performance.

Together, these technologies create a robust platform that empowers users while fostering trust within the financial ecosystem.

Setting Up and Using a Pasonet Account

Setting up a Pasonet account is straightforward and user-friendly. First, visit the official Pasonet website or download the mobile app.

You’ll need to provide some basic personal information, including your name, email address, and phone number. Make sure these details are accurate for verification purposes.

Once you’ve submitted your information, check your email for a confirmation link. Clicking this link will activate your account.

After activation, log in using your credentials. The dashboard is intuitive and provides access to various features like balance inquiries and transaction history.

Navigating through different options feels seamless. You can easily send money or receive funds from other users with just a few taps on the screen.

To enhance security, consider enabling two-factor authentication during setup. This adds an extra layer of protection to your financial transactions while using Pasonet’s services effectively.

Common Concerns and Misconceptions about Pasonet

Many people have questions about Pasonet, often fueled by misconceptions.

One common concern is the fear of security. Users worry about whether their financial data is safe. However, Pasonet employs advanced encryption and security measures to protect personal information.

Another misconception revolves around usability. Some believe that setting up an account is complicated. In reality, the process is straightforward and user-friendly, designed for all levels of tech-savviness.

Then there’s the idea that Pasonet only caters to large businesses. This isn’t true; it serves individuals and small enterprises just as effectively.

Some think that transactions via Pasonet are slow or unreliable. On the contrary, many users report swift and seamless experiences when processing payments or transferring funds through this platform.

Future of Pasonet and its Impact on the Financial Industry

The future of Pasonet looks promising, with advancements poised to reshape the financial landscape. As digital transactions grow, so does the demand for secure and efficient payment methods.

Pasonet is set to become a cornerstone in this evolution. Its emphasis on speed and user-friendliness attracts both consumers and businesses alike. The integration of cutting-edge technology will likely streamline operations, reducing transaction times significantly.

Moreover, as more people embrace online banking, Pasonet can offer innovative solutions tailored to diverse needs. This adaptability positions it well within an ever-changing market.

Regulatory developments will also play a crucial role in shaping its trajectory. With increasing scrutiny over financial systems, ensuring compliance while maintaining efficiency will be essential for long-term success.

As we look ahead, Pasonet’s influence could redefine how people interact with their finances daily. The potential for growth seems endless as it continues to evolve alongside technological advancements.

Conclusion:

As we explore the multifaceted world of pasonet, its significance becomes increasingly clear. This innovative platform has not only transformed how financial transactions are conducted but also redefined user experiences in digital banking. With a rich history and continuous evolution, pasonet stands out as a leader in technological advancements within the financial industry.

The technology behind pasonet showcases incredible capabilities that streamline processes and enhance security for users. Setting up an account is straightforward, making it accessible even to those who may feel intimidated by digital finance solutions. Addressing common misconceptions helps demystify any reluctance surrounding this platform, emphasizing its reliability and efficiency.

Finance

Personalized Digital Campaigns That Resonate with Real Audiences

Personalization is no longer a bonus. It’s the baseline. Every touchpoint in a marketing campaign now carries the potential to shape how a customer feels, responds, and acts. When messages are tailored to actual preferences, performance improves across channels. Yet personalization isn’t just about inserting someone’s name in an email. It involves designing content, visuals, and offers that feel relevant to the moment. In a crowded digital landscape, relevance has become the most valuable currency.

Marketers now use audience signals and data to inform their creative direction across all industries. Behavioral patterns, local interests, and shifting habits form the foundation of responsive campaigns. This allows brands to evolve their outreach in real time, instead of relying on static, one-size-fits-all templates. However, personalization at scale requires more than guesswork. It depends on smart systems and strategic alignment. Understanding how each component contributes to the broader journey helps refine campaigns. The sections that follow explore how this level of precision can be built into digital efforts effectively.

Adapting Campaigns Through Local Insight

Campaigns that resonate often begin with a profound understanding of regional culture and behavior. In large metro areas, people expect brands to mirror their pace, tone, and evolving priorities. Personalization here means going beyond language or visuals and anticipating emotional or contextual relevance. A digital marketing company in New York may use hyperlocal insights to adjust messaging for specific boroughs or neighborhoods. This enhances performance by aligning tone and strategy with each micro-audience’s expectations. The result is not just improved clicks or impressions but more meaningful brand associations. Such efforts create campaigns that feel timely without losing long-term value.

Data fuels this level of responsiveness, but interpretation defines success. Marketers must separate surface-level trends from actionable insights. Local sentiment, especially in fast-moving cities, can shift quickly. Understanding these nuances allows teams to iterate content without diluting brand identity. Personalization, then, becomes a cycle of listening and refining rather than a one-off tactic. Every adjustment made with intention strengthens the connection between brand and user. It’s this repeated alignment that builds long-term loyalty in competitive spaces.

Balancing Automated Tools with Human Strategy

Automation plays a vital role in reaching diverse audiences efficiently. From scheduling content to analyzing behavior, tools help marketers scale efforts without sacrificing consistency. Yet the heart of personalization still relies on interpretation and human-led strategy. A social media agency New York may automate engagement patterns, but insight into tone, timing, and context remains human-driven. This balance allows for quicker reactions while preserving the authenticity users crave. Effective campaigns are those that feel both timely and considered, not robotic or generic. Even the most sophisticated tools require thoughtful input to guide their direction.

Algorithms may surface patterns, but interpretation gives those patterns meaning. Strategy teams often review automated outputs to adjust for emotional tone, relevance, and brand alignment. This oversight ensures that outreach feels aligned with user behavior, not disconnected from it. Without this layer of oversight, campaigns risk becoming noise rather than value. Marketers who treat automation as a support, not a substitute, achieve stronger results. The human element acts as a filter, ensuring that personalization supports the end goal: building real trust. Tools are only as useful as the strategy they’re designed to support.

Building Emotional Relevance at Every Stage

Successful digital campaigns are not built on frequency alone but on how well they resonate emotionally. Audiences are more likely to engage with content that mirrors their values or current mindset. Personalization becomes a way to offer clarity in moments of choice or overload. In New York online marketing, emotional cues help signal whether a campaign feels aligned or off-base. Brands that recognize what people care about, whether it’s convenience, identity, or safety, can tailor messages that feel intuitive. Emotional relevance makes a campaign feel remembered rather than recycled. This sense of resonance drives longer-term retention and stronger conversion.

To do this effectively, teams need to listen more than they speak. Social listening, direct feedback, and performance metrics offer insight into what audiences respond to emotionally. These responses can then be mapped to different journey stages, from awareness to loyalty. Personalization is not a one-time task; it’s a practice that evolves with each campaign cycle. Marketers who revisit their assumptions regularly are better equipped to stay relevant. Campaigns that reflect this effort tend to perform better across all metrics. Emotional relevance keeps content feeling intentional instead of intrusive.

Segmenting Audiences to Refine Personalization

One of the most effective ways to enhance personalization is by segmenting the audience based on behavioral and demographic insights. Segmentation provides structure, allowing marketers to serve content that aligns with each group’s specific priorities. Without this foundational step, messages often land too broadly to create impact. To tailor outreach, you must know the audience, what drives them, and how that changes over time. Age, location, device use, and purchase history can all inform the way content is framed and delivered. These differences influence which formats work best, which platforms to prioritize, and what tone resonates. The better the segmentation, the more naturally personalization can be integrated into the marketing workflow.

However, audience segmentation should not remain static. As people engage with brands, their needs and expectations change, and those shifts should be reflected in updated segment profiles. Re-engagement campaigns, for example, often require different messaging than acquisition strategies. Marketers who track these evolutions gain an edge in delivering timely and relevant content. Segmentation also helps teams measure performance with more clarity, identifying which messages move the needle for which groups. Over time, such data allows for smarter resource allocation and higher campaign efficiency. When segmentation and personalization work together, the result is a more dynamic and user-centric strategy. Instead of just targeting, brands begin connecting with real people in more meaningful ways.

Using Feedback Loops to Improve Campaign Precision

Personalization becomes significantly more powerful when guided by feedback rather than assumptions. Direct and indirect responses from audiences offer critical insight into what works, what feels off and what needs refinement. Feedback loops make it possible to adjust content strategy based on actual user behavior, not just predictions. These loops can include click-through rates, comment sentiment, time-on-page, and exit behavior. Marketers who monitor these indicators closely are able to spot early patterns and adapt quickly. This flexibility helps prevent campaigns from growing stale or disconnected from audience needs. It also transforms the campaign from a one-time push into a living, evolving system.

Content testing plays a key role in strengthening feedback loops. A/B tests, multivariate experiments, and controlled pilots allow teams to evaluate performance in structured ways. Even small adjustments, like headline phrasing or call-to-action placement, can produce measurable changes in engagement. Over time, these iterations form a clearer picture of audience preferences and friction points. Importantly, feedback should be integrated into future planning, not treated as a postmortem. When feedback informs content direction early, campaigns become more proactive rather than reactive. This approach builds long-term relevance and trust. Personalization driven by data, interpreted with care, becomes more aligned with real human experience.

Wrap Up

Personalization continues to shape how marketing teams build relevance in a saturated digital world. When campaigns reflect user priorities rather than broad assumptions, they create real moments of connection. A thoughtful approach ensures that even automated strategies retain human warmth and context. This balance between precision and empathy drives better engagement and long-term outcomes. Every audience wants to feel seen, and personalization makes that recognition scalable. Marketers who listen, interpret, and respond in real time hold a clear advantage. Crafting meaningful content is not about volume but alignment with the present moment. Those who succeed in this space often rely on personalization as both principle and practice.

While tools and tactics evolve, the core idea remains simple. Relevance earns attention. Campaigns that understand their audience achieve more than impressions; they create loyalty. Brands that continuously improve based on real user behavior lead with clarity and intention. This makes every ad, post, or message part of a larger, consistent experience. Personalized campaigns do not just convert. They resonate, linger, and return value over time. The strategy is not just tactical but cultural, requiring sensitivity to shifts and cues.

-

HEALTH2 years ago

HEALTH2 years agoTransformative Health Solutions: Unveiling the Breakthroughs of 10x Health

-

GENERAL2 years ago

GENERAL2 years agoDiscovering the Artistic Brilliance of Derpixon: A Deep Dive into their Animation and Illustration

-

Posts2 years ago

Posts2 years agoSiegel, Cooper & Co.

-

Lifestyle2 years ago

Lifestyle2 years agoPurenudism.com: Unveiling the Beauty of Naturist Lifestyle

-

FASHION2 years ago

FASHION2 years agoThe Many Faces of “λιβαισ”: A Comprehensive Guide to its Symbolism in Different Cultures

-

Lifestyle2 years ago

Lifestyle2 years agoBaddieHub: Unleashing Confidence and Style in the Ultimate Gathering Spot for the Baddie Lifestyle

-

Entertainment2 years ago

Entertainment2 years agoGeekzilla Podcast: Navigating the World of Pop Culture, Gaming, and Tech

-

Lifestyle2 years ago

Lifestyle2 years agoSandra orlow: Unraveling the Story of an Iconic Figure