BUSINESS

Roof Condition Requirements for Solar Panel Installation

Over 2 million U.S. homes have solar power. Before getting solar panels, make sure your roof is in good shape. This guide helps you make a smart decision. Go green with solar panels for homes from Small Energy Bill! Use solar power to reduce energy bills and start a sustainable future. Contact Small Energy Bill today for top-notch solar installations and enjoy solar benefits!

Structural Integrity of Roof

Before installing solar panels, ensure your roof is strong enough. Look into its age, material, damage, and slope to prevent any harm or collapse during bad weather. Consulting a structural engineer or a certified solar installer is wise to check if your roof requires fixing or strengthening for the panels.

Assess Load Capacity

Before getting solar panels, check if your roof can handle the weight. Ask a structural engineer to see if it’s strong enough or needs extra support for the panels.

Check Stability and Support

Inspecting roof trusses and rafters is key to ensure they can handle solar panels, withstand strong winds, and heavy snow. An inspection identifies any sagging or weaknesses, crucial for complex roofs with features like architectural shingles or metal seams, to confirm their strength.

Inspect for Damage or Wear

Checking your roof for damage is key before adding solar panels. Look for missing or damaged shingles, as they can point to bigger problems. Watch out for water damage, leaks, mold, or rot, especially with old roofs made of roll roofing or fiberglass shingles. Spotting these issues early saves time and money later on.

Age and Condition of Roof

Before getting solar panels, make sure your roof isn’t old or damaged because it could need replacing, which costs more. It should be strong for 10-15 more years. The kind of roof you have is important for fitting the panels, so ask an expert if it’s suitable. This way, you’ll make sure your investment in solar panels is worth it.

Evaluate Roof Lifespan

Before installing solar panels, ensure your roof’s lifespan matches the panels’ 30-year durability. If your roof is nearing its end, replace it first to dodge future hassle.

Consider Replacement Needs

Before getting solar panels, check if your old roof needs a full or partial replacement. Using strong materials like asphalt or wood shingles for the new roof can save you money later on. These materials last longer and can better hold up the solar panels under tough conditions.

Maintenance and Repair Tips

Maintain your roof by checking it often to avoid big repairs. Clean gutters and fix or replace broken shingles to prevent water damage. Doing these simple things helps your roof last longer and gets it ready for solar panels.

Roof Material Considerations

Picking the right roof for solar panels is crucial. Metal roofs are best because they last long and make installation easier, leading to more energy. Tile roofs are nice but hard to install safely. Asphalt shingles are less expensive but may not last as long as the panels, leading to extra costs. Ensure your roof is solar-ready to prevent future problems.

Best Materials for Solar

Metal and asphalt shingles are ideal for solar panels. Metal roofs last long and support panels easily, while installing panels on asphalt shingles is straightforward. Plus, solar-reflective shingles boost your home’s energy efficiency. Both choices offer long warranties for dependable use.

Impact on Installation Process

The type of roofing material impacts solar panel installation. If your roof needs fixing, it can slow things down a lot. It’s super important to work with roofing and solar pros to make sure the panels are put on right and avoid problems later.

Maintenance and Longevity

To keep your roof and solar panels in good shape, regularly inspect them and use protective coatings to avoid damage from the weather. This helps catch problems early, ensuring they continue to function well.

Pitch and Angle of Roof

For the best performance from your solar panels, your roof needs to have a slope of 15 to 40 degrees, depending on your location. Pointing them in line with your latitude is key for better energy all year. Adjusting the angle every season can up the power, but it’s more complicated. This info helps make your solar power use more efficient and eco-friendly.

Optimal Angles for Panels

To get the most solar power, place your solar panels right. They need to face south and tilt at your area’s latitude in the northern hemisphere for the best sun. Changing their angle with the seasons can grab more energy. Plus, your roof slope has to fit this setup to catch maximum sunlight.

Adjustments for Different Slopes

To work best, solar panels must match the roof’s angle. Special mounts allow for safe installation on steep or oddly shaped roofs. This ensures solar panels can be set up on various roofs, including those with shingle flaps on slate roofs.

Effects on Energy Efficiency

To get the best solar energy, your roof’s position matters a lot. If it’s in the wrong spot or too shady, your solar panels won’t perform well. But with the right placement, you’ll get maximum sunlight and more energy. This is crucial for roofs that face a lot of wind or shade, ensuring your solar system works well even in less ideal conditions.

Work With A Professional For Your Solar Panel Needs!

Before you get solar panels, make sure your roof is in good shape—think about its age, material, angle, and if it gets a lot of shade. These things impact how well your panels will perform and save you money over time. A solid roof is crucial for a great solar power setup. Considering solar? Check your roof first. Unsure? Ask an expert for help. Begin now for a more eco-friendly future. It all starts with your roof.

BUSINESS

How Mobile Payments Turned Into Fast Cashouts

It’s no secret that mobile payments have revolutionized how you handle money, turning lengthy transactions into instant cashouts. With just a few taps on your phone, you can send, receive, or withdraw funds faster than ever before. Whether you’re splitting bills, paying for services, or accessing your earnings, mobile platforms streamline the process, putting financial control at your fingertips. This shift has made traditional banking delays a thing of the past, giving you the speed and convenience you need in today’s fast-paced world. Here’s how mobile payments transformed into the quick cashouts you rely on daily.

The Rise of Mobile Payments

For years, mobile payments have transformed how you handle money, shifting transactions from physical wallets to your smartphone. With apps like Apple Pay, Venmo, and PayPal, you can now send or receive funds instantly, eliminating the need for cash or cards. This convenience has made mobile payments a staple in your daily life, whether you’re splitting a bill or shopping online. The seamless integration with banking systems ensures your money moves faster than ever, paving the way for quick cashouts and financial flexibility.

Evolution of Payment Technologies

At the heart of mobile payments lies a rapid evolution in technology. From magnetic stripes to NFC and QR codes, each innovation has made transactions smoother for you. Your phone now acts as a digital wallet, storing payment details securely and enabling contactless purchases. Biometric authentication, like fingerprint or facial recognition, adds an extra layer of security, ensuring your transactions are both fast and safe. These advancements have redefined how you interact with money, making traditional methods feel outdated.

Growth of Peer-to-Peer Transactions

For peer-to-peer (P2P) platforms, the rise of mobile payments has been a game-changer. You no longer need to rely on bank transfers or checks to send money to friends or family. Apps like Zelle and Cash App let you transfer funds in seconds, often with just a phone number or email. This shift has made splitting expenses or paying freelancers effortless, putting control of your finances directly in your hands.

In addition, P2P transactions have expanded beyond personal use, becoming a tool for small businesses and gig workers. You can now invoice clients or receive payments instantly, bypassing traditional banking delays. This growth has fueled a culture of instant gratification, where your money is always within reach, ready to be spent or saved as you see fit.

Instant Small Payment Withdrawals

There’s no waiting around with mobile payments—your small withdrawals hit your account instantly. Whether you’re splitting a bill, cashing out gig earnings, or transferring funds to a friend, platforms like Venmo, Cash App, and PayPal make it seamless. You get immediate access to your money, eliminating the delays of traditional banking. This speed transforms how you manage your finances, turning mobile wallets into your go-to for fast, frictionless transactions.

Convenience and Accessibility

Among the biggest advantages of mobile payments is how effortlessly you can access your funds anytime, anywhere. You don’t need to visit a bank or ATM—just a few taps on your phone, and your money is on the way. Whether you’re paying for coffee or sending rent money, the process is streamlined for your convenience. This accessibility ensures you’re always in control of your finances, even on the go.

Impact on Consumer Behavior

Impact is clear: instant withdrawals have reshaped how you spend and save. You’re more likely to make impulsive purchases or split costs instantly, knowing funds are available right away. The immediacy of mobile payments encourages smaller, frequent transactions, altering your budgeting habits. Over time, this shift can lead to a more fluid relationship with money, where waiting feels outdated.

Considering this behavioral shift, you might notice how mobile payments blur the line between spending and saving. The ease of moving money can lead to less deliberate financial decisions, making it necessary to track your transactions. While convenience is unmatched, staying mindful of your spending patterns helps you maintain control over your financial health.

Cashing out small payments – A Cultural Perspective

Any society’s financial habits reflect its cultural values, and South Korea’s embrace of mobile payments is no exception. The rapid adoption of 소액결제 현금화 Cashing out small payments highlights a blend of tech-savviness and a desire for liquidity. You see this practice thrive in a culture where convenience and speed are prioritized, allowing users to bypass traditional banking hurdles. Yet, it also raises questions about financial responsibility and the risks of informal cash flow systems.

Understanding the Practice

By converting small mobile payments into cash, you tap into a system designed for quick access to funds. This method often involves reselling digital vouchers or prepaid credits, turning non-cash assets into spendable money. While it offers flexibility, you should be aware of the fees and potential legal gray areas. The practice is widespread, but understanding its mechanics helps you navigate it wisely.

Implications for Financial Freedom

Beside the immediate convenience, 소액결제 현금화 can empower you with faster liquidity, especially if traditional banking feels restrictive. However, relying on it too heavily may lead to unstable financial habits. You gain short-term flexibility but risk long-term security if not managed carefully.

Cultural attitudes toward debt and spending play a role here. In South Korea, where credit systems are robust yet scrutinized, you might find this workaround appealing. Yet, it’s worth considering how these practices align with your broader financial goals and the societal norms shaping them.

Security Concerns in Fast Cashouts

Unlike traditional payment methods, fast cashouts via mobile payments can expose you to risks like unauthorized transactions or data breaches. Cybercriminals often target quick-transfer systems, exploiting weak authentication or phishing scams to access your funds. While convenience is a priority, ensuring your financial safety requires understanding these vulnerabilities and taking proactive steps to protect your money.

Fraud Prevention Measures

Security starts with choosing platforms that use multi-factor authentication and encryption to safeguard your transactions. Enable notifications for every transaction, so you’re alerted to any suspicious activity. Regularly update your apps and avoid sharing sensitive details over unsecured networks to minimize your exposure to fraud.

Consumer Awareness

After adopting mobile payments, staying informed about common scams is your best defense. Be cautious of unsolicited links or requests for personal information, as these are often tactics used by fraudsters. Verify the legitimacy of payment requests before approving them to avoid falling victim to social engineering attacks.

It also helps to familiarize yourself with your provider’s fraud policies, so you know how to report issues and recover lost funds. By staying vigilant and educating yourself on emerging threats, you can enjoy the speed of fast cashouts without compromising your financial security.

The Role of Financial Institutions

Once again, financial institutions play a pivotal role in shaping how mobile payments evolve into fast cashouts. By integrating advanced security measures and streamlining transaction processes, banks and credit unions ensure your money moves swiftly and safely. They also set the regulatory framework that balances innovation with consumer protection, giving you confidence in every tap or swipe. Without their infrastructure, the seamless experience you enjoy today wouldn’t be possible.

Adapting to the Mobile Payment Landscape

Between traditional banking and digital wallets, financial institutions have had to rethink their strategies to stay relevant. They’ve invested in mobile apps, real-time processing, and user-friendly interfaces to meet your expectations for speed and convenience. By embracing these changes, they’ve made it easier for you to access your funds anytime, anywhere, without compromising security.

Partnerships with Tech Companies

Around the rise of mobile payments, collaborations between banks and tech giants have become a game-changer. These partnerships leverage cutting-edge technology to enhance your experience, from biometric authentication to instant transfers. By working together, they’ve created ecosystems where your transactions feel effortless, whether you’re paying for coffee or splitting rent with friends.

Adapting to the demands of modern consumers, these alliances have also driven innovation in fraud prevention and customer support. You benefit from smarter algorithms that detect unusual activity and round-the-clock assistance, ensuring your money stays protected while moving at the speed of life.

Future Trends in Mobile Payments

Now, mobile payments are evolving faster than ever, with trends like biometric authentication, decentralized finance (DeFi), and AI-driven fraud detection shaping the landscape. You’ll see seamless integration across devices, making transactions quicker and more secure. As digital wallets become smarter, your financial interactions will feel effortless, whether you’re paying bills or splitting costs with friends.

Innovations on the Horizon

Among the breakthroughs you can expect are contactless payments using wearables, like smart rings or glasses, and voice-activated transactions. Blockchain technology will further streamline cross-border payments, reducing fees and wait times. Your mobile wallet might soon predict spending habits, offering personalized discounts before you even check out.

Predictions for Cashout Practices

Innovations in cashout practices will focus on speed and accessibility. You’ll likely see instant transfers becoming the norm, with some platforms offering cashouts in seconds. Peer-to-peer networks and decentralized apps could eliminate intermediaries, putting more control in your hands.

Cashout processes will also become more transparent, with real-time tracking and lower fees. As demand grows, expect competitive rewards for frequent users, like cashback or loyalty points. Your ability to access funds anytime, anywhere, will redefine convenience in mobile finance.

Conclusion

To wrap up, mobile payments have streamlined the way you access your money, turning lengthy transactions into fast cashouts. By leveraging digital wallets and instant transfer features, you can now move funds seamlessly, whether for personal use or business needs. The convenience of tapping your phone eliminates traditional banking delays, putting financial control at your fingertips. As technology evolves, these systems will only grow faster and more secure, ensuring your transactions remain efficient. Adopting mobile payments not only saves time but also enhances your financial flexibility, making it a smart choice for modern money management.

BUSINESS

The most important questions small business owners should ask

You’re not alone. Another $4.99 million in new businesses have opened this year, too. No wonder you have a lot of questions.

After all, you have to look after all aspects of small business as an entrepreneur. Or you’ve simply been dumbstruck and not able to understand where to start from.

Don’t worry. A lot of people face such issues when they start their own business. Let me help you with some ideas. I’ll share a list of 4 questions that most entrepreneurs ask me. Maybe you will get some valuable leads from there-

#1: “I don’t have enough resources, but a lot on the plate to handle. Where to begin?”

I know getting along is tough. The main issue is that you don’t have the main men in supporting roles like your C-suite. Here’s the trick. You have to do strong networking.

Now, how will that help you?

Firstly, who should you network with? Preferably, people like attorneys, accountants, and fellow business owners. They can sync with your purpose. At the same time, they will give you valuable advice, opinions, and suggestions.

You may also consider tools like Secure Plus checks. The automated check software handles your financial part. At least, you can easily keep a tab on your costs without breaking a sweat.

#2: I lag in digital innovation. Without a digital presence, I would lose customers. What do I do?”

When the pandemic hit, 75% of the US businesses without a digital presence fell from their positions to ground 0. Cut to today! A lot of consumers expect that even small businesses like bakeries and repairs will have their full-fledged digital profiles.

There are a lot of tools that help you set up your website. But most companies spend the lion’s share of their marketing budget on digital campaigns like content marketing and SEO.

There is a range of free tools to get your work done. You may need just a few people on your team to build the whole digital ecosystem.

After your digital ecosystem is up and running, you can get traction from a lot of sources. You can expect to tap into a range of new territories too.

#3: How to pitch your business to gain access to more capital?

A lot of people mess up their finances, mixing them with their business. So, I refrain from doing that. Instead, approach a capitalist or an institution (preferably banks, as they offer low interest rates) for financial support.

You’re not alone. Another $4.99 million in new businesses have opened this year, too. No wonder you have a lot of questions.

After all, you have to look after all aspects of small business as an entrepreneur. Or you’ve simply been dumbstruck and not able to understand where to start from.

Don’t worry. A lot of people face such issues when they start their own business. Let me help you with some ideas. I’ll share a list of 4 questions that most entrepreneurs ask me. Maybe you will get some valuable leads from there-

#1: “I don’t have enough resources, but a lot on the plate to handle. Where to begin?”

I know getting along is tough. The main issue is that you don’t have the main men in supporting roles like your C-suite. Here’s the trick. You have to do strong networking.

Now, how will that help you?

Firstly, who should you network with? Preferably, people like attorneys, accountants, and fellow business owners. They can sync with your purpose. At the same time, they will give you valuable advice, opinions, and suggestions.

You may also consider tools like Secure Plus checks. The automated check software handles your financial part. At least, you can easily keep a tab on your costs without breaking a sweat.

#2: I lag in digital innovation. Without a digital presence, I would lose customers. What do I do?”

When the pandemic hit, 75% of the US businesses without a digital presence fell from their positions to ground 0. Cut to today! A lot of consumers expect that even small businesses like bakeries and repairs will have their full-fledged digital profiles.

There are a lot of tools that help you set up your website. But most companies spend the lion’s share of their marketing budget on digital campaigns like content marketing and SEO.

There is a range of free tools to get your work done. You may need just a few people on your team to build the whole digital ecosystem.

After your digital ecosystem is up and running, you can get traction from a lot of sources. You can expect to tap into a range of new territories too.

#3: How to pitch your business to gain access to more capital?

A lot of people mess up their finances, mixing them with their business. So, I refrain from doing that. Instead, approach a capitalist or an institution (preferably banks, as they offer low interest rates) for financial support.

You’re not alone. Another $4.99 million in new businesses have opened this year, too. No wonder you have a lot of questions.

After all, you have to look after all aspects of small business as an entrepreneur. Or you’ve simply been dumbstruck and not able to understand where to start from.

Don’t worry. A lot of people face such issues when they start their own business. Let me help you with some ideas. I’ll share a list of 4 questions that most entrepreneurs ask me. Maybe you will get some valuable leads from there-

#1: “I don’t have enough resources, but a lot on the plate to handle. Where to begin?”

I know getting along is tough. The main issue is that you don’t have the main men in supporting roles like your C-suite. Here’s the trick. You have to do strong networking.

Now, how will that help you?

Firstly, who should you network with? Preferably, people like attorneys, accountants, and fellow business owners. They can sync with your purpose. At the same time, they will give you valuable advice, opinions, and suggestions.

You may also consider tools like Secure Plus checks. The automated check software handles your financial part. At least, you can easily keep a tab on your costs without breaking a sweat.

#2: I lag in digital innovation. Without a digital presence, I would lose customers. What do I do?”

When the pandemic hit, 75% of the US businesses without a digital presence fell from their positions to ground 0. Cut to today! A lot of consumers expect that even small businesses like bakeries and repairs will have their full-fledged digital profiles.

There are a lot of tools that help you set up your website. But most companies spend the lion’s share of their marketing budget on digital campaigns like content marketing and SEO.

There is a range of free tools to get your work done. You may need just a few people on your team to build the whole digital ecosystem.

After your digital ecosystem is up and running, you can get traction from a lot of sources. You can expect to tap into a range of new territories too.

#3: How to pitch your business to gain access to more capital?

A lot of people mess up their finances, mixing them with their business. So, I refrain from doing that. Instead, approach a capitalist or an institution (preferably banks, as they offer low interest rates) for financial support.

You’re not alone. Another $4.99 million in new businesses have opened this year, too. No wonder you have a lot of questions.

After all, you have to look after all aspects of small business as an entrepreneur. Or you’ve simply been dumbstruck and not able to understand where to start from.

Don’t worry. A lot of people face such issues when they start their own business. Let me help you with some ideas. I’ll share a list of 4 questions that most entrepreneurs ask me. Maybe you will get some valuable leads from there-

#1: “I don’t have enough resources, but a lot on the plate to handle. Where to begin?”

I know getting along is tough. The main issue is that you don’t have the main men in supporting roles like your C-suite. Here’s the trick. You have to do strong networking.

Now, how will that help you?

Firstly, who should you network with? Preferably, people like attorneys, accountants, and fellow business owners. They can sync with your purpose. At the same time, they will give you valuable advice, opinions, and suggestions.

You may also consider tools like Secure Plus checks. The automated check software handles your financial part. At least, you can easily keep a tab on your costs without breaking a sweat.

#2: I lag in digital innovation. Without a digital presence, I would lose customers. What do I do?”

When the pandemic hit, 75% of the US businesses without a digital presence fell from their positions to ground 0. Cut to today! A lot of consumers expect that even small businesses like bakeries and repairs will have their full-fledged digital profiles.

There are a lot of tools that help you set up your website. But most companies spend the lion’s share of their marketing budget on digital campaigns like content marketing and SEO.

There is a range of free tools to get your work done. You may need just a few people on your team to build the whole digital ecosystem.

After your digital ecosystem is up and running, you can get traction from a lot of sources. You can expect to tap into a range of new territories too.

#3: How to pitch your business to gain access to more capital?

A lot of people mess up their finances, mixing them with their business. So, I refrain from doing that. Instead, approach a capitalist or an institution (preferably banks, as they offer low interest rates) for financial support.

You’re not alone. Another $4.99 million in new businesses have opened this year, too. No wonder you have a lot of questions.

After all, you have to look after all aspects of small business as an entrepreneur. Or you’ve simply been dumbstruck and not able to understand where to start from.

Don’t worry. A lot of people face such issues when they start their own business. Let me help you with some ideas. I’ll share a list of 4 questions that most entrepreneurs ask me. Maybe you will get some valuable leads from there-

#1: “I don’t have enough resources, but a lot on the plate to handle. Where to begin?”

I know getting along is tough. The main issue is that you don’t have the main men in supporting roles like your C-suite. Here’s the trick. You have to do strong networking.

Now, how will that help you?

Firstly, who should you network with? Preferably, people like attorneys, accountants, and fellow business owners. They can sync with your purpose. At the same time, they will give you valuable advice, opinions, and suggestions.

You may also consider tools like Secure Plus checks. The automated check software handles your financial part. At least, you can easily keep a tab on your costs without breaking a sweat.

#2: I lag in digital innovation. Without a digital presence, I would lose customers. What do I do?”

When the pandemic hit, 75% of the US businesses without a digital presence fell from their positions to ground 0. Cut to today! A lot of consumers expect that even small businesses like bakeries and repairs will have their full-fledged digital profiles.

There are a lot of tools that help you set up your website. But most companies spend the lion’s share of their marketing budget on digital campaigns like content marketing and SEO.

There is a range of free tools to get your work done. You may need just a few people on your team to build the whole digital ecosystem.

After your digital ecosystem is up and running, you can get traction from a lot of sources. You can expect to tap into a range of new territories too.

#3: How to pitch your business to gain access to more capital?

A lot of people mess up their finances, mixing them with their business. So, I refrain from doing that. Instead, approach a capitalist or an institution (preferably banks, as they offer low interest rates) for financial support.

Meanwhile, the pitch you are preparing is most crucial. Always try to reflect the potential of your business verticals. Reflect the objectives of the upcoming 5 years. At the same time, state your business figures. If your numbers are low, you must flaunt a clear plan to improve revenues.

Before you move with your business, you need to get some things straight. Firstly, you have to create your business checking account. In the meantime, you can apply for small business credit cards.

That’s the most lucrative way to fund the business verticals. However, it is better not to use your credit sources, like your own credit card or your loan, for your business needs.

If you mix your finances with those of your business, the banks might become confused. It would be difficult to get a clear picture of the company’s finances.

#4 What do we do to overcome the effect of inflation?

It depends mainly on the business. If you have an inventory, then your inventory management should be top-notch. Don’t spend more than you have. Also, ensure that you have a good grip on your cash flow.

During heavy inflation, your expenses may easily surpass your earnings. So, you must handle your front-end operations properly. Most importantly, you should hire a social media expert to promote your brand and scale up your business.

BUSINESS

The Digital Nomad’s 2025 Guide to Online Privacy While Traveling

You’re sipping espresso in a Lisbon café, editing your latest client project. The Wi-Fi is free. So is the hacker watching your every move.

Digital nomads are more connected than ever — and more exposed. From accidental overshares on Instagram to sketchy hotel internet, every country you visit brings a new set of privacy pitfalls.

In some cases, your digital trail can even be weaponized against you through tactics like doxxing — where personal details are leaked or used maliciously online.

This isn’t about fear — it’s about freedom. In this guide, you’ll discover how to secure your data, devices, and digital identity, so you can roam the world with peace of mind in 2025.

Why Online Privacy Matters More Than Ever for Digital Nomads

Life on the road is exhilarating — but also unpredictable. As digital nomads rely on remote access to sensitive files, finances, and communication tools, their personal data is increasingly vulnerable.

Whether you’re hopping between Airbnb stays, working in shared co-working spaces, or broadcasting your location on social media, your digital footprint becomes a roadmap for malicious actors. In 2025, with cyberattacks and personal data exposure on the rise, privacy isn’t a luxury — it’s a necessity.

8 Real-World Privacy Risks Nomads Face on the Road

1. Public Wi-Fi Networks & Data Interception

Open Wi-Fi at airports, cafés, and co-working spaces is notoriously unsafe. Hackers can easily intercept unencrypted data — including passwords, emails, and credit card details — through man-in-the-middle attacks.

2. Oversharing Locations on Social Media

Instagram stories, Twitter check-ins, and Facebook updates can inadvertently reveal your exact location and routine, making it easier for bad actors to track your movements or impersonate you online.

💡 Pro Tip: Delay your posts by 24 hours and remove metadata like geotags.

3. Device Theft in Hostels or Co-Working Spaces

It only takes a moment of distraction for someone to grab your laptop or phone. Without strong locks or biometric access, a thief could gain access to everything from work files to personal photos.

4. Unsecured Cloud Sync & Auto Backups

Many travelers keep cloud syncing on by default. But syncing on an unsecured network can expose sensitive files — especially if your device is set to auto-connect or auto-upload.

🔗 Related: What is Doxxing and How to Protect Yourself — understanding how personal data can be used against you is key to proactive defense.

5. SIM Swap & Phone Number Hijacking

SIM swap fraud can lock you out of your phone, bank, and 2FA-protected accounts. Travelers who use temporary or virtual numbers may be especially vulnerable.

6. Border Searches and Device Confiscation

Certain countries allow border agents to access your devices without a warrant. Without encryption or travel-specific device precautions, your data could be copied or detained.

7. Shoulder Surfing in Public Spaces

Whether you’re booking a flight or logging into PayPal, it’s surprisingly easy for someone nearby to observe or film your screen.

8. Malicious QR Codes and Travel Scams

From free Wi-Fi access signs to fake tour offers, QR code phishing has become a growing scam targeting international travelers.

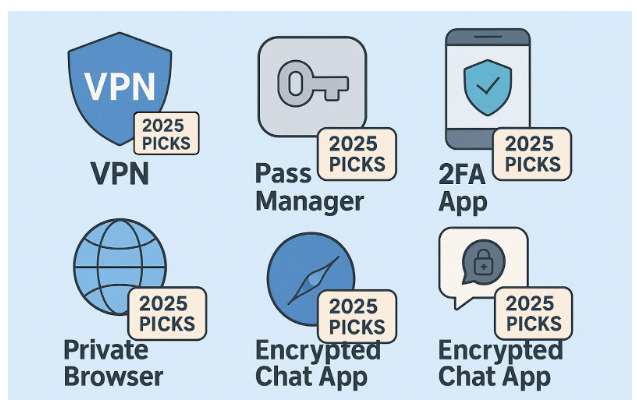

Essential Privacy Tools Every Nomad Should Use in 2025

In the age of remote work, using the right privacy tools is the first line of defense.

Virtual Private Networks (VPNs)

A quality VPN like X-VPN encrypts your internet traffic, masking your IP and shielding you from network-based attacks.

Password Managers

Tools like 1Password or Bitwarden store your credentials securely and can generate ultra-strong passwords — far better than “Lisbon2025!”

2FA (Two-Factor Authentication)

Wherever possible, enable two-factor authentication. Use an authenticator app over SMS for added security, especially abroad.

Encrypted Messaging Apps

Use apps like Signal or Telegram for business and personal communication — especially when dealing with clients or sensitive files.

Private Browsers & Extensions

Browsers like Brave or Firefox with privacy extensions block trackers and fingerprinting scripts that follow you around the web.

Top Privacy Habits for Remote Workers Abroad

1. Secure Devices Before Traveling

- Turn on full-disk encryption

- Enable remote wipe for laptops and phones

- Disable auto-connect to open Wi-Fi networks

2. Review Social App Permissions

- Apps often track more than you think. Turn off location access where unnecessary and review privacy settings weekly.

3. Delay Posting & Remove Metadata

- Use tools like ExifCleaner to strip photo metadata before posting.

- Wait until you leave a location before sharing details publicly.

4. Use Burner Emails & Travel Phone Numbers

- For public Wi-Fi logins or signups, use disposable email addresses.

- Consider a separate SIM or eSIM for travel-related accounts.

Location-Specific Tips: How Privacy Laws Differ Around the World

Not all countries treat your data the same way. As a digital nomad, it’s worth knowing the regulatory landscape:

🇪🇺 Europe (GDPR Stronghold)

The General Data Protection Regulation (GDPR) provides strong protections — but only for EU citizens. Tourists may not be covered in the same way.

🇹🇭 Thailand / 🇮🇩 Indonesia

These countries have newer data laws but limited enforcement. Local internet cafés and SIM vendors may store ID info with little oversight.

🇺🇸 United States

Strong consumer rights in some states (like California), but little federal oversight. Law enforcement has broad access in some cases.

Final Thoughts: Staying Safe and Free in the Digital World

Living as a digital nomad in 2025 is an incredible opportunity — one that comes with great responsibility over your digital presence. With cyber threats growing and personal data becoming more valuable than ever, staying proactive about your privacy isn’t just smart — it’s essential.

Whether you’re working from a mountain town in Colombia or a co-working space in Prague, taking a few extra steps to secure your devices and protect your online identity can mean the difference between a smooth journey and a digital disaster.

Travel boldly, live freely — and always guard your digital trail.

-

GENERAL1 year ago

GENERAL1 year agoDiscovering the Artistic Brilliance of Derpixon: A Deep Dive into their Animation and Illustration

-

Posts1 year ago

Posts1 year agoSiegel, Cooper & Co.

-

Lifestyle1 year ago

Lifestyle1 year agoPurenudism.com: Unveiling the Beauty of Naturist Lifestyle

-

Lifestyle1 year ago

Lifestyle1 year agoBaddieHub: Unleashing Confidence and Style in the Ultimate Gathering Spot for the Baddie Lifestyle

-

HEALTH1 year ago

HEALTH1 year agoTransformative Health Solutions: Unveiling the Breakthroughs of 10x Health

-

Entertainment1 year ago

Entertainment1 year agoGeekzilla Podcast: Navigating the World of Pop Culture, Gaming, and Tech

-

Entertainment1 year ago

Entertainment1 year agoKhatrimaza Unveiled: Exploring Cinematic Marvels and Entertainment Extravaganza

-

BUSINESS1 year ago

BUSINESS1 year agoUnlocking the Secrets to Jacqueline Tortorice Remarkable Career and Accomplishments