BUSINESS

Unlocking the Potential of Corporate Credit Card Cashing

Managing cash flow effectively is a key factor for any business, and corporate credit card cashing provides an opportunity to access immediate funds without relying on traditional financial products. In this blog post, we’ll explore the benefits and risks of corporate credit card cashing, methods to maximize its efficiency, and alternatives to consider for better financial management.

Understanding Corporate Credit Card Cashing

Corporate credit card cashing refers to the process of withdrawing funds from a company’s credit card. This practice is especially helpful for businesses that need quick access to cash or capital, often for short-term operational needs. Although not typically the most cost-effective method, it offers flexibility and speed in situations where more traditional forms of financing may not be viable.

What is Corporate Credit Card Cashing?

Corporate credit card cashing involves withdrawing cash directly from a company’s credit card, typically through cash advances or a credit card processor. This method allows businesses to access immediate funds, which can be crucial for covering operational expenses, payroll, or urgent financial needs. Unlike personal credit card cashing, which is often subject to higher fees and interest rates, corporate cards may offer more flexibility in terms of limits and the ability to leverage cash flow for the business.

- How It Works: Businesses can either take a cash advance at an ATM or use payment processors that allow them to transfer available credit to a bank account. Cash advances, however, come with fees and are often subject to high-interest rates, which is why this method should be used strategically.

- Why It’s Different: Corporate credit cards are generally issued to businesses, giving companies higher credit limits and the ability to cover larger expenses compared to personal credit cards. This makes them particularly attractive for managing company cash flow, especially when businesses are unable to access traditional loans.

Why Cashing Corporate Credit Cards is Beneficial

Cashing corporate credit cards offers several advantages that can help improve the financial flexibility of a business. When managed correctly, this option can provide several benefits:

- Quick Access to Funds: One of the primary advantages of cashing 신용카드 현금화 corporate credit cards is the immediacy. Unlike applying for traditional loans, which can take weeks to process, credit card advances provide instant access to funds that can be used immediately.

- Short-Term Financial Relief: Small to medium-sized businesses can use corporate credit card cashing to cover urgent operational costs, such as inventory purchases, payroll, or unforeseen expenses. This can be especially useful in situations where cash flow is temporarily tight but a quick solution is necessary.

- Flexible Payment Terms: Some corporate credit cards offer more flexible repayment schedules or higher limits, which allows businesses to manage their finances more effectively. The key here is to repay the cash advance as quickly as possible to avoid accumulating interest.

Risks Involved in Corporate Credit Card Cashing

While corporate credit card cashing offers certain benefits, it is not without risks. Businesses should be cautious and consider the potential drawbacks before deciding to cash out their corporate credit cards.

- High Fees and Interest Rates: One of the most significant risks associated with cashing corporate cards is the fees. Credit card cash advances often come with hefty service charges and high-interest rates, which can quickly add up if the business is unable to pay off the balance in a short time. These costs can diminish the financial flexibility provided by the cash advance.

- Potential Impact on Credit Rating: Although cashing a corporate credit card may not directly impact personal credit scores, it can affect the company’s credit rating if the business fails to make timely payments. This can make it more difficult to secure favorable financing options in the future.

- Increased Debt: Excessive use of credit card cashing can lead to the accumulation of unmanageable debt. If businesses continually rely on cash advances to cover operational costs, they may find themselves in a cycle of debt that is difficult to break.

By understanding these risks, businesses can avoid pitfalls and make informed decisions when using corporate credit card cashing as a financing option.

Effective Methods for Corporate Credit Card Cashing

Now that we understand the concept and risks associated with corporate credit card cashing, it’s important to explore effective methods businesses can use to maximize the benefits of this financial tool. Here are some strategies to help businesses utilize corporate credit cards for cashing in a cost-effective manner:

Methods for Accessing Cash from Corporate Credit Cards

There are several ways to access cash from a corporate credit card. While some methods may be more suitable depending on the business’s financial situation, it’s important to choose wisely.

- Cash Advances: The most direct method of accessing funds from a corporate credit card is through a cash advance. This can typically be done at an ATM or directly from a bank, allowing businesses to withdraw money against their available credit limit. However, be mindful of high interest rates and transaction fees that can be charged for cash advances. These can increase the overall cost of using this method.

- Using Payment Processors: Another method is using payment processors such as Square or PayPal, which can allow businesses to transfer funds from their credit cards into a business bank account. This is an alternative to traditional cash advances and may offer a more streamlined process, but businesses should still be aware of any associated fees.

Maximizing Corporate Credit Card Limits

To make the most out of corporate credit card cashing, businesses should work on increasing their credit limits. Higher credit limits provide greater flexibility and can improve cash flow management.

- Requesting Limit Increases: If your business has consistently demonstrated good payment history, you may be able to request an increase in your credit card limit. This can provide additional available funds when needed, giving businesses more breathing room in times of financial strain.

- Managing Multiple Cards: For businesses with multiple corporate cards, it’s essential to manage each card’s limit efficiently. You may want to allocate specific cards for different types of expenses to better track your cash flow and optimize your credit usage.

Alternatives to Corporate Credit Card Cashing

While cashing corporate credit cards can be a quick solution, it’s not always the best option. Businesses should also consider other financing methods that may offer lower costs and fewer risks.

- Traditional Loans and Lines of Credit: Depending on the business’s financial health, a small business loan or line of credit may be a better option. These typically offer lower interest rates and longer repayment terms, which can help businesses manage cash flow over a longer period without incurring high fees.

- Invoice Financing: For businesses with unpaid invoices, invoice financing can provide quick access to cash without resorting to credit cards. Invoice financing involves borrowing against outstanding invoices, giving businesses immediate funds to cover expenses.

By carefully selecting the right method for accessing funds and managing credit limits, businesses can maximize the potential of corporate credit card cashing while minimizing risks.

FAQ – Common Questions About Corporate Credit Card Cashing

1. What is corporate credit card cashing?

Corporate credit card cashing is the process of withdrawing funds from a company’s credit card, often through cash advances or using payment processors to transfer funds to a business bank account. This method allows businesses to quickly access cash for operational expenses.

2. What are the benefits of using corporate credit cards for cashing?

The main benefits include quick access to funds for urgent expenses, flexible repayment options, and the ability to manage short-term cash flow needs without requiring traditional loans. Corporate credit card cashing can be a valuable tool when used strategically.

3. What are the risks of corporate credit card cashing?

The risks include high transaction fees, interest rates, and potential impact on credit ratings if payments are not made on time. Additionally, using cash advances repeatedly can lead to unmanageable debt if not monitored carefully.

4. How can businesses increase their credit card limits?

Businesses can request higher limits from their credit card provider by demonstrating a solid payment history, increased revenue, or providing additional financial documentation to prove they can handle higher limits responsibly.

5. Are there alternatives to corporate credit card cashing?

Yes, businesses can consider alternatives such as small business loans, lines of credit, or invoice financing, which often offer lower fees and more favorable terms compared to credit card cash advances.

BUSINESS

The most important questions small business owners should ask

You’re not alone. Another $4.99 million in new businesses have opened this year, too. No wonder you have a lot of questions.

After all, you have to look after all aspects of small business as an entrepreneur. Or you’ve simply been dumbstruck and not able to understand where to start from.

Don’t worry. A lot of people face such issues when they start their own business. Let me help you with some ideas. I’ll share a list of 4 questions that most entrepreneurs ask me. Maybe you will get some valuable leads from there-

#1: “I don’t have enough resources, but a lot on the plate to handle. Where to begin?”

I know getting along is tough. The main issue is that you don’t have the main men in supporting roles like your C-suite. Here’s the trick. You have to do strong networking.

Now, how will that help you?

Firstly, who should you network with? Preferably, people like attorneys, accountants, and fellow business owners. They can sync with your purpose. At the same time, they will give you valuable advice, opinions, and suggestions.

You may also consider tools like Secure Plus checks. The automated check software handles your financial part. At least, you can easily keep a tab on your costs without breaking a sweat.

#2: I lag in digital innovation. Without a digital presence, I would lose customers. What do I do?”

When the pandemic hit, 75% of the US businesses without a digital presence fell from their positions to ground 0. Cut to today! A lot of consumers expect that even small businesses like bakeries and repairs will have their full-fledged digital profiles.

There are a lot of tools that help you set up your website. But most companies spend the lion’s share of their marketing budget on digital campaigns like content marketing and SEO.

There is a range of free tools to get your work done. You may need just a few people on your team to build the whole digital ecosystem.

After your digital ecosystem is up and running, you can get traction from a lot of sources. You can expect to tap into a range of new territories too.

#3: How to pitch your business to gain access to more capital?

A lot of people mess up their finances, mixing them with their business. So, I refrain from doing that. Instead, approach a capitalist or an institution (preferably banks, as they offer low interest rates) for financial support.

You’re not alone. Another $4.99 million in new businesses have opened this year, too. No wonder you have a lot of questions.

After all, you have to look after all aspects of small business as an entrepreneur. Or you’ve simply been dumbstruck and not able to understand where to start from.

Don’t worry. A lot of people face such issues when they start their own business. Let me help you with some ideas. I’ll share a list of 4 questions that most entrepreneurs ask me. Maybe you will get some valuable leads from there-

#1: “I don’t have enough resources, but a lot on the plate to handle. Where to begin?”

I know getting along is tough. The main issue is that you don’t have the main men in supporting roles like your C-suite. Here’s the trick. You have to do strong networking.

Now, how will that help you?

Firstly, who should you network with? Preferably, people like attorneys, accountants, and fellow business owners. They can sync with your purpose. At the same time, they will give you valuable advice, opinions, and suggestions.

You may also consider tools like Secure Plus checks. The automated check software handles your financial part. At least, you can easily keep a tab on your costs without breaking a sweat.

#2: I lag in digital innovation. Without a digital presence, I would lose customers. What do I do?”

When the pandemic hit, 75% of the US businesses without a digital presence fell from their positions to ground 0. Cut to today! A lot of consumers expect that even small businesses like bakeries and repairs will have their full-fledged digital profiles.

There are a lot of tools that help you set up your website. But most companies spend the lion’s share of their marketing budget on digital campaigns like content marketing and SEO.

There is a range of free tools to get your work done. You may need just a few people on your team to build the whole digital ecosystem.

After your digital ecosystem is up and running, you can get traction from a lot of sources. You can expect to tap into a range of new territories too.

#3: How to pitch your business to gain access to more capital?

A lot of people mess up their finances, mixing them with their business. So, I refrain from doing that. Instead, approach a capitalist or an institution (preferably banks, as they offer low interest rates) for financial support.

You’re not alone. Another $4.99 million in new businesses have opened this year, too. No wonder you have a lot of questions.

After all, you have to look after all aspects of small business as an entrepreneur. Or you’ve simply been dumbstruck and not able to understand where to start from.

Don’t worry. A lot of people face such issues when they start their own business. Let me help you with some ideas. I’ll share a list of 4 questions that most entrepreneurs ask me. Maybe you will get some valuable leads from there-

#1: “I don’t have enough resources, but a lot on the plate to handle. Where to begin?”

I know getting along is tough. The main issue is that you don’t have the main men in supporting roles like your C-suite. Here’s the trick. You have to do strong networking.

Now, how will that help you?

Firstly, who should you network with? Preferably, people like attorneys, accountants, and fellow business owners. They can sync with your purpose. At the same time, they will give you valuable advice, opinions, and suggestions.

You may also consider tools like Secure Plus checks. The automated check software handles your financial part. At least, you can easily keep a tab on your costs without breaking a sweat.

#2: I lag in digital innovation. Without a digital presence, I would lose customers. What do I do?”

When the pandemic hit, 75% of the US businesses without a digital presence fell from their positions to ground 0. Cut to today! A lot of consumers expect that even small businesses like bakeries and repairs will have their full-fledged digital profiles.

There are a lot of tools that help you set up your website. But most companies spend the lion’s share of their marketing budget on digital campaigns like content marketing and SEO.

There is a range of free tools to get your work done. You may need just a few people on your team to build the whole digital ecosystem.

After your digital ecosystem is up and running, you can get traction from a lot of sources. You can expect to tap into a range of new territories too.

#3: How to pitch your business to gain access to more capital?

A lot of people mess up their finances, mixing them with their business. So, I refrain from doing that. Instead, approach a capitalist or an institution (preferably banks, as they offer low interest rates) for financial support.

You’re not alone. Another $4.99 million in new businesses have opened this year, too. No wonder you have a lot of questions.

After all, you have to look after all aspects of small business as an entrepreneur. Or you’ve simply been dumbstruck and not able to understand where to start from.

Don’t worry. A lot of people face such issues when they start their own business. Let me help you with some ideas. I’ll share a list of 4 questions that most entrepreneurs ask me. Maybe you will get some valuable leads from there-

#1: “I don’t have enough resources, but a lot on the plate to handle. Where to begin?”

I know getting along is tough. The main issue is that you don’t have the main men in supporting roles like your C-suite. Here’s the trick. You have to do strong networking.

Now, how will that help you?

Firstly, who should you network with? Preferably, people like attorneys, accountants, and fellow business owners. They can sync with your purpose. At the same time, they will give you valuable advice, opinions, and suggestions.

You may also consider tools like Secure Plus checks. The automated check software handles your financial part. At least, you can easily keep a tab on your costs without breaking a sweat.

#2: I lag in digital innovation. Without a digital presence, I would lose customers. What do I do?”

When the pandemic hit, 75% of the US businesses without a digital presence fell from their positions to ground 0. Cut to today! A lot of consumers expect that even small businesses like bakeries and repairs will have their full-fledged digital profiles.

There are a lot of tools that help you set up your website. But most companies spend the lion’s share of their marketing budget on digital campaigns like content marketing and SEO.

There is a range of free tools to get your work done. You may need just a few people on your team to build the whole digital ecosystem.

After your digital ecosystem is up and running, you can get traction from a lot of sources. You can expect to tap into a range of new territories too.

#3: How to pitch your business to gain access to more capital?

A lot of people mess up their finances, mixing them with their business. So, I refrain from doing that. Instead, approach a capitalist or an institution (preferably banks, as they offer low interest rates) for financial support.

You’re not alone. Another $4.99 million in new businesses have opened this year, too. No wonder you have a lot of questions.

After all, you have to look after all aspects of small business as an entrepreneur. Or you’ve simply been dumbstruck and not able to understand where to start from.

Don’t worry. A lot of people face such issues when they start their own business. Let me help you with some ideas. I’ll share a list of 4 questions that most entrepreneurs ask me. Maybe you will get some valuable leads from there-

#1: “I don’t have enough resources, but a lot on the plate to handle. Where to begin?”

I know getting along is tough. The main issue is that you don’t have the main men in supporting roles like your C-suite. Here’s the trick. You have to do strong networking.

Now, how will that help you?

Firstly, who should you network with? Preferably, people like attorneys, accountants, and fellow business owners. They can sync with your purpose. At the same time, they will give you valuable advice, opinions, and suggestions.

You may also consider tools like Secure Plus checks. The automated check software handles your financial part. At least, you can easily keep a tab on your costs without breaking a sweat.

#2: I lag in digital innovation. Without a digital presence, I would lose customers. What do I do?”

When the pandemic hit, 75% of the US businesses without a digital presence fell from their positions to ground 0. Cut to today! A lot of consumers expect that even small businesses like bakeries and repairs will have their full-fledged digital profiles.

There are a lot of tools that help you set up your website. But most companies spend the lion’s share of their marketing budget on digital campaigns like content marketing and SEO.

There is a range of free tools to get your work done. You may need just a few people on your team to build the whole digital ecosystem.

After your digital ecosystem is up and running, you can get traction from a lot of sources. You can expect to tap into a range of new territories too.

#3: How to pitch your business to gain access to more capital?

A lot of people mess up their finances, mixing them with their business. So, I refrain from doing that. Instead, approach a capitalist or an institution (preferably banks, as they offer low interest rates) for financial support.

Meanwhile, the pitch you are preparing is most crucial. Always try to reflect the potential of your business verticals. Reflect the objectives of the upcoming 5 years. At the same time, state your business figures. If your numbers are low, you must flaunt a clear plan to improve revenues.

Before you move with your business, you need to get some things straight. Firstly, you have to create your business checking account. In the meantime, you can apply for small business credit cards.

That’s the most lucrative way to fund the business verticals. However, it is better not to use your credit sources, like your own credit card or your loan, for your business needs.

If you mix your finances with those of your business, the banks might become confused. It would be difficult to get a clear picture of the company’s finances.

#4 What do we do to overcome the effect of inflation?

It depends mainly on the business. If you have an inventory, then your inventory management should be top-notch. Don’t spend more than you have. Also, ensure that you have a good grip on your cash flow.

During heavy inflation, your expenses may easily surpass your earnings. So, you must handle your front-end operations properly. Most importantly, you should hire a social media expert to promote your brand and scale up your business.

BUSINESS

The Digital Nomad’s 2025 Guide to Online Privacy While Traveling

You’re sipping espresso in a Lisbon café, editing your latest client project. The Wi-Fi is free. So is the hacker watching your every move.

Digital nomads are more connected than ever — and more exposed. From accidental overshares on Instagram to sketchy hotel internet, every country you visit brings a new set of privacy pitfalls.

In some cases, your digital trail can even be weaponized against you through tactics like doxxing — where personal details are leaked or used maliciously online.

This isn’t about fear — it’s about freedom. In this guide, you’ll discover how to secure your data, devices, and digital identity, so you can roam the world with peace of mind in 2025.

Why Online Privacy Matters More Than Ever for Digital Nomads

Life on the road is exhilarating — but also unpredictable. As digital nomads rely on remote access to sensitive files, finances, and communication tools, their personal data is increasingly vulnerable.

Whether you’re hopping between Airbnb stays, working in shared co-working spaces, or broadcasting your location on social media, your digital footprint becomes a roadmap for malicious actors. In 2025, with cyberattacks and personal data exposure on the rise, privacy isn’t a luxury — it’s a necessity.

8 Real-World Privacy Risks Nomads Face on the Road

1. Public Wi-Fi Networks & Data Interception

Open Wi-Fi at airports, cafés, and co-working spaces is notoriously unsafe. Hackers can easily intercept unencrypted data — including passwords, emails, and credit card details — through man-in-the-middle attacks.

2. Oversharing Locations on Social Media

Instagram stories, Twitter check-ins, and Facebook updates can inadvertently reveal your exact location and routine, making it easier for bad actors to track your movements or impersonate you online.

💡 Pro Tip: Delay your posts by 24 hours and remove metadata like geotags.

3. Device Theft in Hostels or Co-Working Spaces

It only takes a moment of distraction for someone to grab your laptop or phone. Without strong locks or biometric access, a thief could gain access to everything from work files to personal photos.

4. Unsecured Cloud Sync & Auto Backups

Many travelers keep cloud syncing on by default. But syncing on an unsecured network can expose sensitive files — especially if your device is set to auto-connect or auto-upload.

🔗 Related: What is Doxxing and How to Protect Yourself — understanding how personal data can be used against you is key to proactive defense.

5. SIM Swap & Phone Number Hijacking

SIM swap fraud can lock you out of your phone, bank, and 2FA-protected accounts. Travelers who use temporary or virtual numbers may be especially vulnerable.

6. Border Searches and Device Confiscation

Certain countries allow border agents to access your devices without a warrant. Without encryption or travel-specific device precautions, your data could be copied or detained.

7. Shoulder Surfing in Public Spaces

Whether you’re booking a flight or logging into PayPal, it’s surprisingly easy for someone nearby to observe or film your screen.

8. Malicious QR Codes and Travel Scams

From free Wi-Fi access signs to fake tour offers, QR code phishing has become a growing scam targeting international travelers.

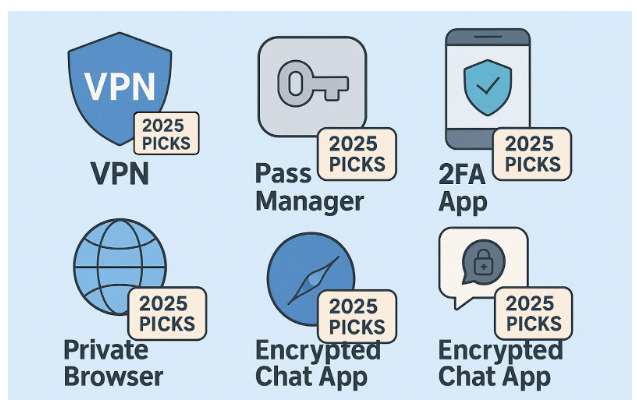

Essential Privacy Tools Every Nomad Should Use in 2025

In the age of remote work, using the right privacy tools is the first line of defense.

Virtual Private Networks (VPNs)

A quality VPN like X-VPN encrypts your internet traffic, masking your IP and shielding you from network-based attacks.

Password Managers

Tools like 1Password or Bitwarden store your credentials securely and can generate ultra-strong passwords — far better than “Lisbon2025!”

2FA (Two-Factor Authentication)

Wherever possible, enable two-factor authentication. Use an authenticator app over SMS for added security, especially abroad.

Encrypted Messaging Apps

Use apps like Signal or Telegram for business and personal communication — especially when dealing with clients or sensitive files.

Private Browsers & Extensions

Browsers like Brave or Firefox with privacy extensions block trackers and fingerprinting scripts that follow you around the web.

Top Privacy Habits for Remote Workers Abroad

1. Secure Devices Before Traveling

- Turn on full-disk encryption

- Enable remote wipe for laptops and phones

- Disable auto-connect to open Wi-Fi networks

2. Review Social App Permissions

- Apps often track more than you think. Turn off location access where unnecessary and review privacy settings weekly.

3. Delay Posting & Remove Metadata

- Use tools like ExifCleaner to strip photo metadata before posting.

- Wait until you leave a location before sharing details publicly.

4. Use Burner Emails & Travel Phone Numbers

- For public Wi-Fi logins or signups, use disposable email addresses.

- Consider a separate SIM or eSIM for travel-related accounts.

Location-Specific Tips: How Privacy Laws Differ Around the World

Not all countries treat your data the same way. As a digital nomad, it’s worth knowing the regulatory landscape:

🇪🇺 Europe (GDPR Stronghold)

The General Data Protection Regulation (GDPR) provides strong protections — but only for EU citizens. Tourists may not be covered in the same way.

🇹🇭 Thailand / 🇮🇩 Indonesia

These countries have newer data laws but limited enforcement. Local internet cafés and SIM vendors may store ID info with little oversight.

🇺🇸 United States

Strong consumer rights in some states (like California), but little federal oversight. Law enforcement has broad access in some cases.

Final Thoughts: Staying Safe and Free in the Digital World

Living as a digital nomad in 2025 is an incredible opportunity — one that comes with great responsibility over your digital presence. With cyber threats growing and personal data becoming more valuable than ever, staying proactive about your privacy isn’t just smart — it’s essential.

Whether you’re working from a mountain town in Colombia or a co-working space in Prague, taking a few extra steps to secure your devices and protect your online identity can mean the difference between a smooth journey and a digital disaster.

Travel boldly, live freely — and always guard your digital trail.

BUSINESS

Know Your Rights: A Citizen’s Guide to Legal Protections

Introduction

Understanding your constitutional rights during interactions with law enforcement is essential for every citizen. This guide provides an overview of key legal protections guaranteed by the U.S. Constitution and relevant case law. While this information serves as a general educational resource, it is not a substitute for personalized legal advice from a qualified attorney.

The Fourth Amendment: Protection Against Unreasonable Searches and Seizures

The Fourth Amendment protects citizens against unreasonable searches and seizures by government officials, including police officers. This means:

- Warrant Requirement: In most cases, police need a warrant to search your home, vehicle, or personal belongings.

- Probable Cause: For a warrant to be issued, officers must demonstrate probable cause that evidence of a crime will be found.

- Exceptions: Several exceptions exist, including:

- Consent searches

- Plain view doctrine

- Searches incident to a lawful arrest

- Automobile exception (with probable cause)

- Exigent circumstances (emergencies)

The Fifth Amendment: Protection Against Self-Incrimination

The Fifth Amendment includes several important protections, most notably the right against self-incrimination:

- Right to Remain Silent: You cannot be compelled to provide testimony that might incriminate yourself.

- Miranda Rights: If you are in custody and being interrogated, officers must inform you of your rights to:

- Remain silent

- Be informed that anything you say can be used against you

- Have an attorney present during questioning

- Have an attorney appointed if you cannot afford one

The Sixth Amendment: Right to Counsel

The Sixth Amendment guarantees the right to legal representation:

- Right to an Attorney: You have the right to be represented by an attorney in all criminal proceedings.

- Public Defenders: If you cannot afford an attorney, one will be appointed to represent you.

- When the Right Attaches: This right begins at critical stages of prosecution, starting with formal charges.

During Police Encounters: Know Your Rights

Traffic Stops

- Remain calm and keep your hands visible.

- You must provide your license, registration, and proof of insurance when requested.

- You have the right to remain silent beyond providing basic identifying information.

- You may refuse consent to search your vehicle, but officers may search if they have probable cause.

- You are not required to answer questions about where you’re going or where you’ve been.

Street Encounters

- Ask if you are free to leave. If yes, you may calmly walk away.

- If detained, you have the right to know why you are being detained.

- You do not have to consent to a search of your person or belongings, though officers may conduct a limited pat-down for weapons if they have reasonable suspicion.

- Remaining silent cannot be used as evidence of guilt.

Home Encounters

- You do not have to open your door for police unless they have a warrant.

- You may ask to see the warrant before allowing entry.

- If officers have a valid search warrant, you should not interfere with their search, but you can observe and take notes.

- Without a warrant, you can deny entry (with some exceptions for emergency situations).

How to Exercise Your Rights

When Interacting with Police

- Stay calm and be respectful. Hostility can escalate situations unnecessarily.

- Clearly state that you are exercising your rights. For example: “I do not consent to a search” or “I am exercising my right to remain silent.”

- Ask if you are free to leave. If not, ask why you are being detained.

- Request an attorney immediately if arrested. Say clearly: “I want to speak with an attorney.”

- Do not resist arrest, even if you believe the arrest is unlawful. Legal challenges should be made in court, not on the street.

Documenting the Encounter

- Mental notes: Remember officer names, badge numbers, patrol car numbers.

- Witnesses: Note if there are witnesses to the interaction.

- Written record: As soon as possible, write down everything you remember.

- Medical attention: Seek medical attention immediately if injured and document all injuries.

When Professional Legal Help Is Necessary

While understanding your rights is crucial, navigating the legal system requires professional expertise in many situations:

- If you’ve been arrested or charged with a crime

- If your rights have been violated

- If you’re unsure about the legality of police actions

- Before making any statements to police in a criminal investigation

Finding the Right Legal Representation

- Criminal defense specialists have specific expertise in protecting citizens’ rights during criminal proceedings.

- Legal aid organizations can provide representation if you cannot afford an attorney.

- Bar association referrals can help you find qualified attorneys in your area.

- Public defenders are trained specifically in criminal defense.

Important Disclaimer

This guide provides general information about legal principles and is not legal advice tailored to specific situations. Laws vary by state and locality, and legal precedents evolve over time. Always consult with a qualified attorney for advice about your specific circumstances.

Resources for Further Information

- American Civil Liberties Union (ACLU): www.aclu.org

- National Legal Aid & Defender Association: www.nlada.org

- American Bar Association: www.americanbar.org

- State and local bar associations

- Legal aid organizations in your community

Conclusion

Knowledge of your constitutional rights is an essential component of citizenship, but it is only the first step. When facing serious legal situations, professional legal counsel is invaluable. Criminal law specialists are trained to navigate the complexities of the legal system and provide the personalized guidance necessary to protect your rights and interests.

Remember: The best protection is a combination of knowledge, calm assertion of your rights, and appropriate professional legal representation when needed.

-

GENERAL1 year ago

GENERAL1 year agoDiscovering the Artistic Brilliance of Derpixon: A Deep Dive into their Animation and Illustration

-

Posts1 year ago

Posts1 year agoSiegel, Cooper & Co.

-

Lifestyle1 year ago

Lifestyle1 year agoPurenudism.com: Unveiling the Beauty of Naturist Lifestyle

-

Lifestyle1 year ago

Lifestyle1 year agoBaddieHub: Unleashing Confidence and Style in the Ultimate Gathering Spot for the Baddie Lifestyle

-

HEALTH1 year ago

HEALTH1 year agoTransformative Health Solutions: Unveiling the Breakthroughs of 10x Health

-

Entertainment1 year ago

Entertainment1 year agoGeekzilla Podcast: Navigating the World of Pop Culture, Gaming, and Tech

-

Entertainment1 year ago

Entertainment1 year agoKhatrimaza Unveiled: Exploring Cinematic Marvels and Entertainment Extravaganza

-

BUSINESS1 year ago

BUSINESS1 year agoUnlocking the Secrets to Jacqueline Tortorice Remarkable Career and Accomplishments